I will talk about when I was saved by XM’s negative balance protection (NBP) system.

It is proof that there really is a negative balance protection system.

I don’t want to remember….

Moreover, it is said that the negative amount was reset after tens of minutes without any application.

It helped me a lot, and the mental burden is quite different just because there is negative balance protection system.

I also advise on how to manage risk with using this system.

- Introduction – Negative Balance Protection (NBP) System –

- What is Negative Balance Protection System?

- Cases that Negative Balance Protection System is not applied

- Some Countries are Obliged to Introduce Negative Balance Protection System

- The Story that I’ve Got Loss Cut

- 9 March 2020, Monday

- What Happened at That Time (What Did I Do)

- Negative Balance

- Automatically Applied Negative Balance Protection System

- How to Use my XM Account At That Time

- How to Hedge Risks?

- Summary

- Open an Account in XM Now!

Introduction – Negative Balance Protection (NBP) System –

So far, I have touched on negative balance protection system in articles.

The features of forex broker are

- High Leverage

- Gorgeous Bonus Programs

- Negative Balance protection System (NBP)

Because of these three characteristics, you can start forex trading with a small amount of money.

Above all, regarding negative balance protection system, the motivation to start forex trading changes greatly depending on whether it is present or not.

It can be said that the value of forex brokers is due to negative balance protection system.

There are no disadvantages to negative balance protection system.

In the unlikely event that your balance becomes negative, you will not be in debt.

In other words, this is the biggest reason for starting forex trading with these brokers who offer this system.

As for negative balance protection system, many information is found around on the internet, such as it was not applied, application was required, it was not reset to zero until the next deposit, so beginners are a little worried. You may think.

What to hide, I’ve benefited from negative balance protection system about three times so far! (Lol)

Once with HotForex and twice with XM.

In conclusion, negative balance protection system was applied in each case, and the account balance was reset to zero.

There is no problem at all.

What is Negative Balance Protection System?

Negative balance protection system is a mechanism that returns the negative account balance to zero.

As the name implies, the minus amount will be compensated, so traders will not be in debt more than they have deposited.

When does the account balance become negative?

On the contrary, when you hold a position, the market price may move significantly, and the loss cut may not be in time and the account balance may become negative.

Since forex brokers have low stop out standards, especially when you have a large lot or multiple positions, you will not encounter a loss cut indefinitely and the unrealized loss will temporarily increase and the balance may become negative.

After that, the market will return and turn positive, or even if it does not reach that level, it would be nice if the unrealized loss returned to some extent and the account balance became positive, but without returning as it is, you may encounter a stop out or you may cut the loss yourself (there is an unrealized loss).

In some cases, it may be forcibly closed.

As a result, your account balance can be negative.

Cases that Negative Balance Protection System is not applied

Negative balance protection system will not be applied in the following cases.

- When there is unrealized gain in other positions and the balance does not become negative

- If you have cross order in same account or in another account

- If you have cross order in another broker’s account

Case 1 is easy to understand.

Even if the USD/JPY position is negative, if the EUR/USD position is large and positive, the total is not negative. Negative balance protection system does not apply in these cases.

Be careful about case 2 and 3.

Regarding case 2, cross trade is allowed by most brokers.

It can be done for risk hedging.

If the market moves significantly while holding a position in both of buying and selling, one side encounters a loss cut and negative balance protection system is applied.

Another position has profits, so in the end, if you offset it, the balance will be positive.

As a result, the balance is not negative same as case 1, so it is not subject to this system.

Negative balance protection system is applied only when the account itself has a negative balance.

It’s easy to misunderstand, but it’s not the case when a position becomes negative (when there is a loss).

Case 3 is to have a cross order position at the same timing among multiple brokers.

At first glance, it doesn’t seem to come out, but it seems to come out.

If you get caught, not only will negative balance protection system not be applied, but your account will also be frozen.

Please note that it may be done without malicious intent.

Some Countries are Obliged to Introduce Negative Balance Protection System

As far as I know, every forex broker has introduced negative balance protection system.

Some regulations require this system.

The European Securities and Markets Authority (ESMA) in Europe requires to protect their negative balances, that is, to introduce negative balance protection system. The purpose is to protect investors. Investors can open an account with confidence.

Negative balance protection means firms must limit the retail client’s aggregate liability for all CFDs connected to a CFD trading account to the funds in that CFD trading account. This implies that a client can never lose more money than the funds specifically dedicated to CFD trading.

https://www.esma.europa.eu/sites/default/files/library/esma35-36-1262_technical_qas_product_intervention.pdf

The Story that I’ve Got Loss Cut

Now, from here, I would like to introduce my case.

It’s shame story, but I will tell you all.

It occurred in March 2020 when USD/JPY pair fell sharply (the market moved in the direction of yen appreciation) due to the influence of the covid-19.

At that time, I was trading USD/JPY with XM.

The balance of the account was a little over 100,000 yen (About $ 1,000), and I had withdrawn some profit from that account a while ago.

In addition, the credit balance that include the deposit bonus was about 100,000 yen, so the effective margin was just over 200,000 yen (about $2,000).

9 March 2020, Monday

After the opening of the Tokyo market on March 9, 2020 (Monday), USD/JPY pair fell sharply.

Most recently, there was a “Flash-Crash” in January 2019, but it happened again.

The coronavirus gradually spread from the beginning of 2020, but at first it was perceived as a story limited to China.

Perhaps because of that, the dollar is raising the price of wrinkles, and in February 2020, it hit the latest high of 112 yen.

After that, even though the wrinkles were lowered, no one expected the momentary decline so far. I was one of them.

What Happened at That Time (What Did I Do)

NY market closed at 105.330 last Friday.

When Tokyo market started, there was a big gap.

The opening price is 104.19 yen. It started with a strong yen of 1.145 yen compared to the closed price of NY.

It started with a significant decline, so I should have been very cautious at this point in the future.

But I was not.

I placed a buy position, thinking that this gap would fill soon as usual.

Although it has been declining since February 2020, I didn’t expect it to drop all at once.

In addition, I was actually able to get on with this long downtrend and make some profits.

I was unsuspecting.

After that, I raised it a little until 103.511.

It will drop further from here.

I have placed more buy positions in preparation for the price increase.

It also increased the number of lots and had a total of three buy positions.

This was all the mistake.

I waited for it to go up without losing money, but it fell more.

It was further lowered around the start timing of NY market trading hours, the margin maintenance rate became 20% and less, I closed all positions with loss when the first stop out has occurred automatically.

It fell to a maximum of 101.174 at midnight Thai time, so it is unlikely that it would have helped anyway.

Negative Balance

This is the state of the balance immediately after the loss cut.

It’s a wonderful minus.

Including the accumulated credits, I have lost about 220,000 to 230,000 yen.

My smartphone time is Thai time.

I couldn’t afford to take screenshots while holding a position, and I didn’t run this website, so I don’t have any screenshots about negative positions.

I saved the screenshot to keep the negative balance as a memorial (as a commandment to myself).

Automatically Applied Negative Balance Protection System

This is a screenshot tens of minutes after that.

The balance has already been reset to zero.

Despite midnight Thai time.

Some websites explain that XM’s negative balance protection system will not be reset to zero unless you make a deposit when your balance is negative, but that is not true.

I haven’t contacted or applied for anything, but it was automatically reset to zero after about 30 minutes.

In addition, as the balance is negatively compensated, the deposit bonus up to that point has also disappeared automatically.

How to Use my XM Account At That Time

XM is mainly used as a dedicated account for USD/JPY trading.

It is said that XM has a wide spread, USD/JPYcan be traded at about 1.5 to 1.6 pips.

In addition, there is a deposit bonus, so it feels like a spread of about 75%.

Furthermore, if you accumulate XM points, you will be cashed back up to $ 5 per lot, so the actual spread is calculated to be about 0.7 to 0.8 pips.

With XM, I can get a total deposit bonus of up to $ 5,000.

Once I have used up my deposit bonus, I may stop trading on XM.

However, I still have a deposit bonus of about $ 4,000, so I deposit it again and use it for trading.

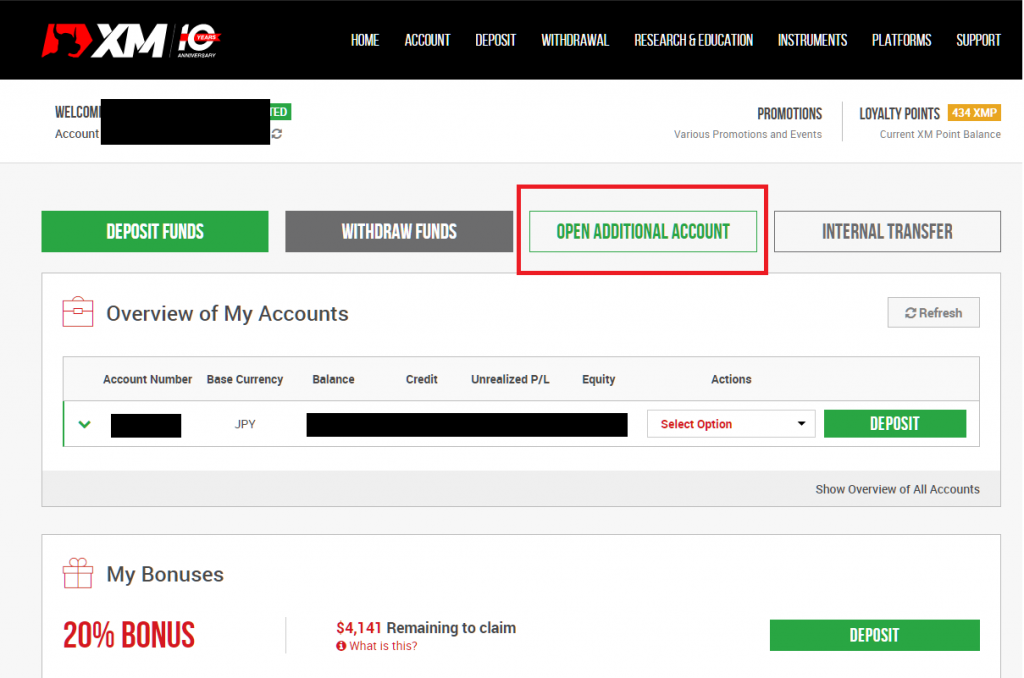

On the other hand, we can create additional accounts up to a total of 10 accounts on XM.

I have another account to keep profits away.

Shortly before I got this loss, the profit was transferred to another account, so I transferred the funds from another account again and resumed trading.

The screen is my XM member portal screen.

You can find a button to open an additional account.

Click to display the screen for selecting leverage and account currency, and click the open account button to create an additional account immediately.

If you have already verified your identity, you do not need to upload additional documents.

It’s not a hassle at all, so I recommend that you create two or more accounts from the beginning.

Refer to another article that shows you how to open an additional account.

How to Hedge Risks?

Just because you have negative balance protection system does not mean that your risk is zero.

The amount you deposit may be a loss.

Aim for greater profits with utilizing benefit of high leverage and negative balance protection system.

However, trade with as low risk as possible.

For that reason, I strongly recommend the following operations.

- Operate with surplus funds

- Withdraw profits frequently or transfer to another account

- Operate distributed over multiple accounts

① Operate with surplus funds

I never say that it is money that can be thrown away, but please trade with extra funds.

Not to mention, don’t even trade in debt.

Please prepare it as an investment fund, not as a part of your living money.

It doesn’t matter if you start with a small amount of money.

Whether it’s $100 yen or $500.

② Withdraw profits frequently or transfer to another account

Withdraw profits frequently.

Of course, you can increase the amount of money and trade in larger lots (so-called compound interest effect), but at least if the trade is successful and you can make a profit as same as the first deposit, withdraw it or move it to another account.

At that point, the investment amount has been 100% recovered, so subsequent trades are risk-free.

If you use a broker which allows to create multiple accounts like XM, transfer profit to another account, and if you use a trader which allows only one account like iFOREX, withdraw profit frequently.

③ Operate distributed over multiple accounts

If you want to trade different currency pairs or in different leverages, I recommend operating with multiple accounts.

If it is the same account, the leverage will be unified.

For example, in the case of XM, leverage can be set for each account created, so for example, when trading with a minor currency pair with high volatility, and if you want to lower the leverage to reduce risk, create another account and set a low leverage by yourself.

Some brokers are strong at certain currency pairs and offer narrow spreads. (For example, LAND-FX and iFOREX are strong at EURUSD, HotForex XAUUSD, etc.)

You can also use different brokers according to the trade target.

(I do that too)

Please refer to another article for the difference in spreads of each broker.

When trading the same currency pair with multiple brokers, please be careful not to be penalized for cross trading as mentioned above.

Summary

I believe you can understand what the negative balance protection system is, the biggest advantage of forex brokers, and the operation that makes good use of high leverage and negative balance protection system.

In this way, one of the ways to utilize forex broker is to start with a small amount of funds, but again, please try to operate and trade with as little risk as possible.

Open an Account in XM Now!

You can open an account with XM for free.

The process is very easy.

Take this opportunity to open an account and get XM’s account opening bonus and deposit bonus.

Click the button below to open XM’s official website in a new tab.

Please follow the instructions to open an account.

\Just 3 minutes!!/

Access to XM Official website

Click OPEN AN ACCOUNT on the top page.

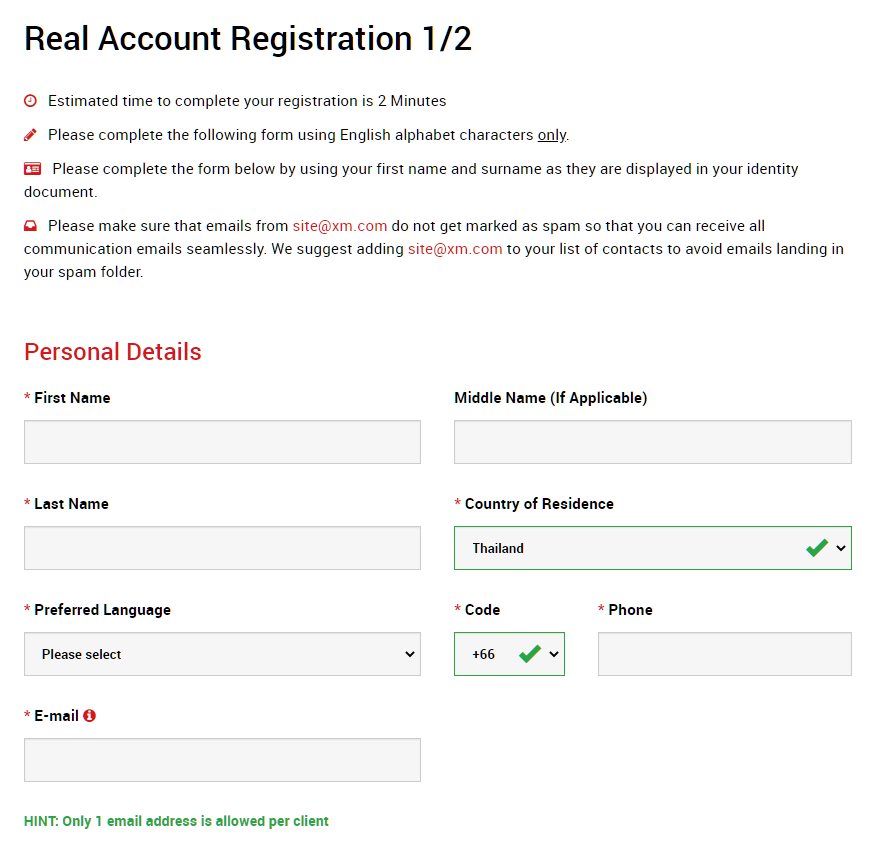

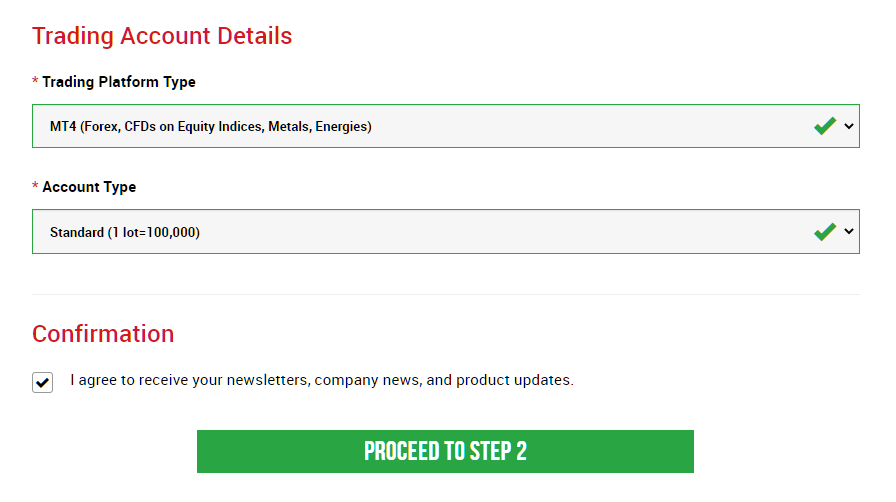

Real Account Registration 1/2

Fill in personal details information.

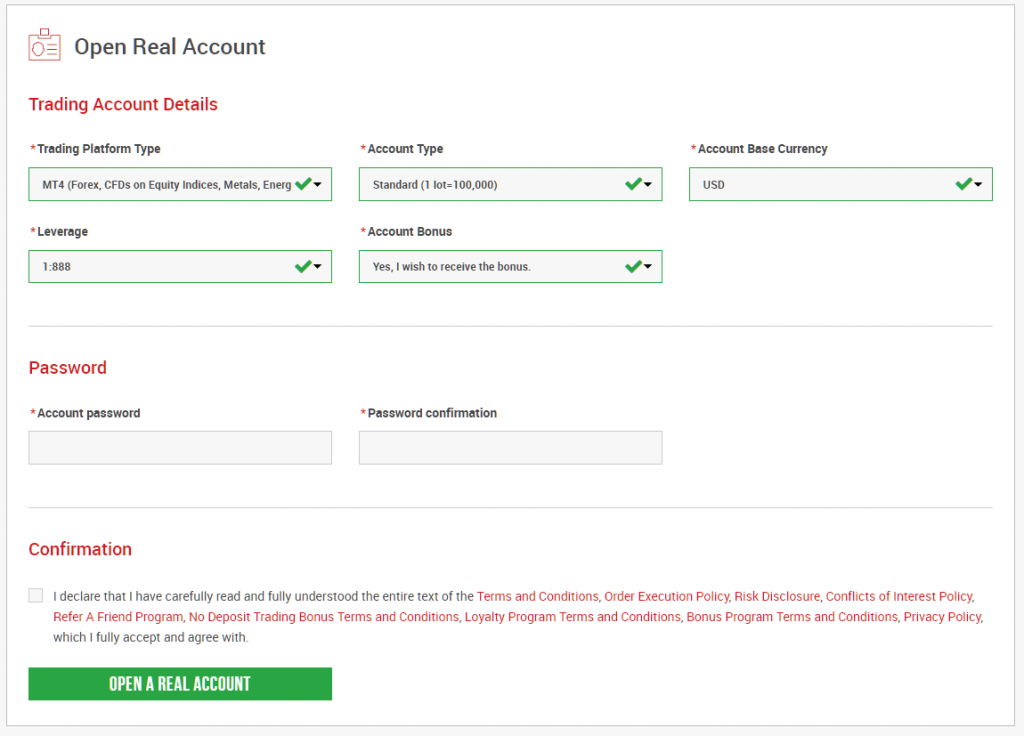

Trading Account Details

Select your trading platform (MT4 or MT5), and

Select your account type.

If you are not sure about the account type, I recommend to select STANDARD account for now.

You will also receive a bonus.

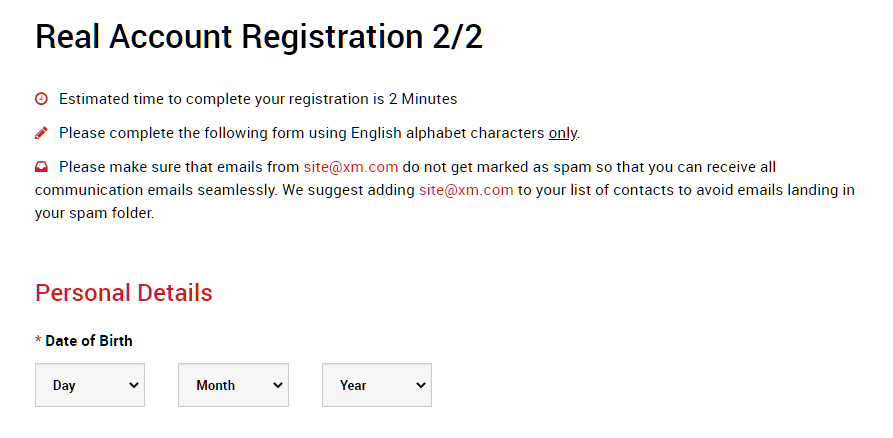

Real Account Registration 2/2

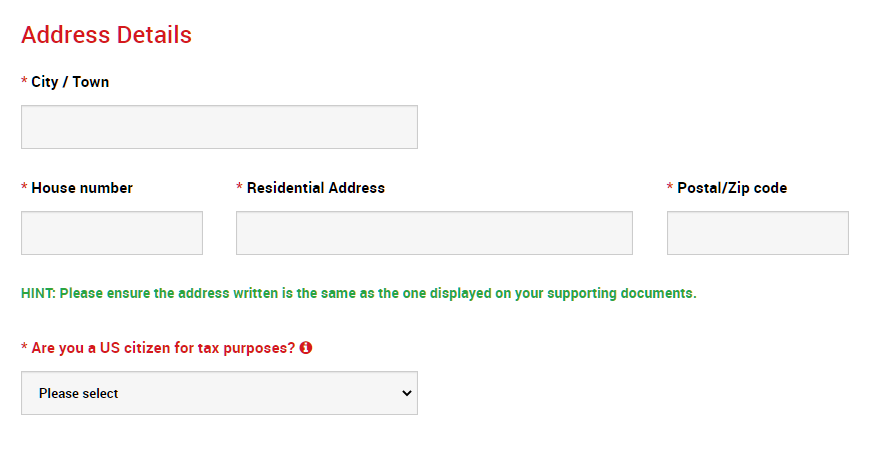

Enter personal infromation.

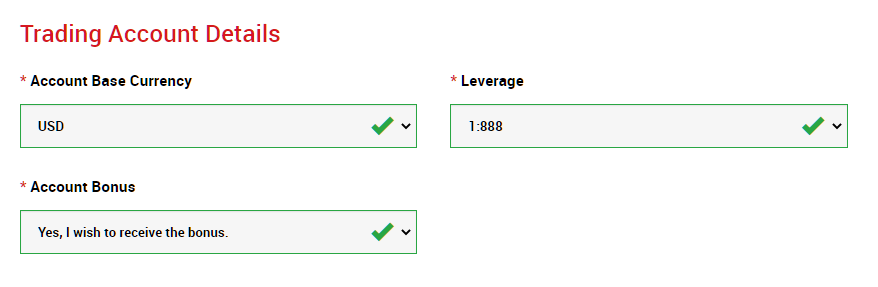

Trading Account Details

Specify the base currency and maximum leverage of your account.

If you want to receive the account opening bonus, please select “Receive” here.

(You can also choose not to receive it.)

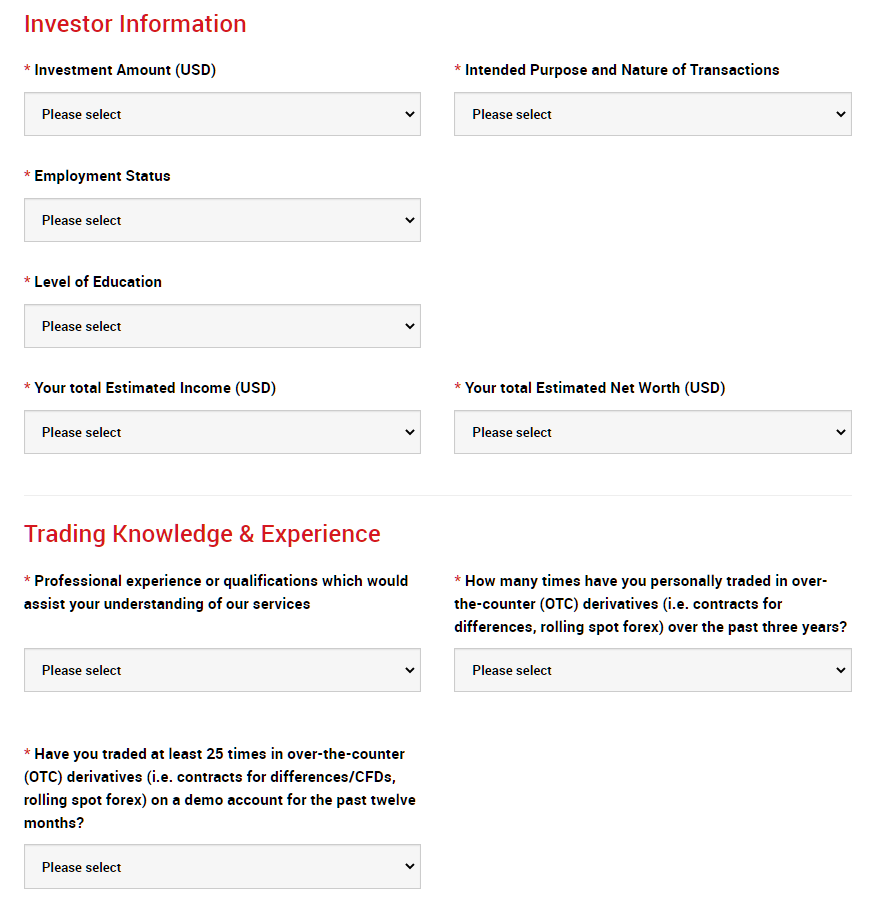

Investor Information

Fill in all area about occupation, investment experience, etc.

This is KYC process that every financial institution must do.

Account Password

Finally, set your password. Use this password to log in to your XM member page or trading account (MT4 or MT5).

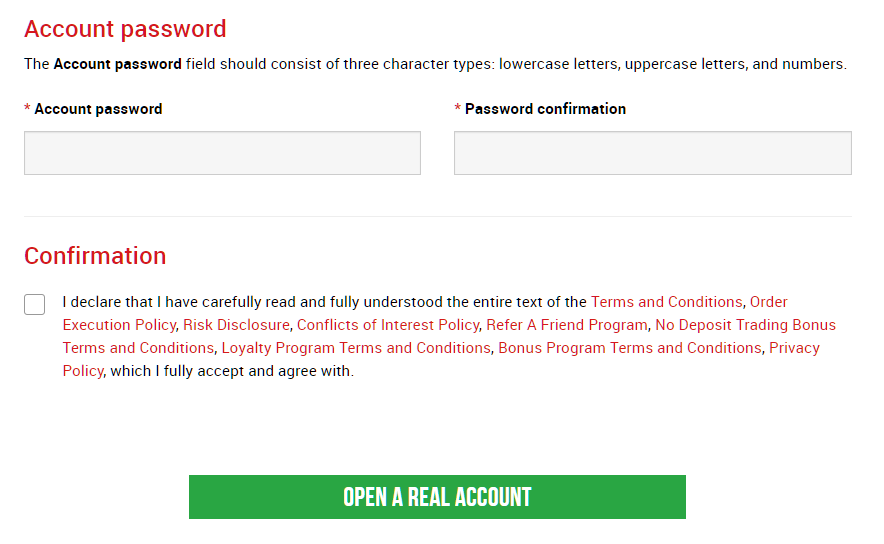

Then, authenticate your email address.

You will then receive an email with your MT4/MT5 account ID and the name of your connection server.

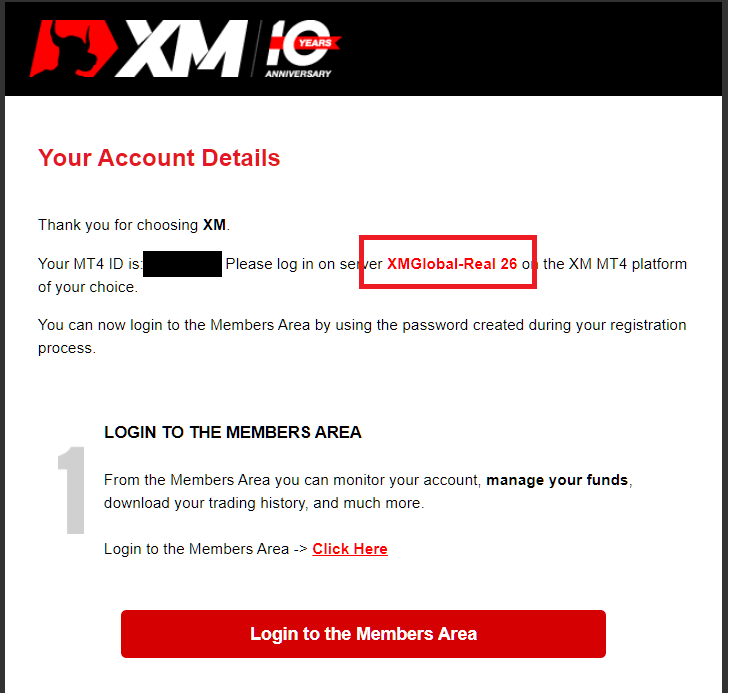

Upload Documents for Identity Verification

Upload your identity verification documents and complete the KYC process.

You can make a deposit and start trading without verifying your identity, but you will need to verify your identity to make a withdrawal.

Claim Trading Bonus

Once the identity verification process is complete, you will see a button to receive the account opening bonus on your member page.

Click on it to receive your account opening bonus.

Install Trading Tool

Install MetaTrader, a trading tool.

The PC version is available from the official XM website.

The smartphone app can be installed from the App Store or Google Play.

For the PC version, please refer to “XM MT4/MT5 | How to Download, Install and Login“.

For the smartphone app version, please refer to “How to Install MT4/MT5 Mobile App“.

Deposit and Trade

Deposit money into your trading account.

The deposit bonus will be transferred to your trading account when it is deposited.

For more information about XM’s deposit methods, please refer to the separate article “XM Deposit Methods | Fees and Conditions“.

Once you deposit, all you have to do is trade.

Take advantage of the account opening bonus and deposit bonus to maximize your profits.

For detailed instructions on how to open an account with XM, please refer to the separate article “XM | How to Open an Account“.

\Just 3 minutes!!/

コメント