Introduction – Forex Brokers for US Traders –

In the United States, the Dodd Frank Wall Street Reform and Consumer Protection Act (hereinafter referred to as the Dodd Frank Act), which came into effect in 2011, imposes very strict restrictions on forex brokers.

Also, due to the anti-money laundering regulation law, many offshore brokers have stopped their business in the US market.

As a result, finding a forex broker for traders who want to start forex trading has become a bit of hard for all US residents, not just American people.

This article introduces forex brokers that accept US residents.

As far as I can tell, all brokers are reliable.

About Dodd-Frank Act

The Dodd Frank Act imposes the following strict restrictions on forex brokers:

- Prohibition of high leverage (up to 1:50)

- Separate and manage customer assets

- Capital at least $ 20 million

This regulation is very strict, and many brokers withdrew from the US market, especially because the capital regulation could not be cleared.

It is said there were dozens of brokers, has became only four at that time.

On the other hand, brokers that are not based in the United States, so-called offshore brokers, have been providing services in the US market even before the enforcement of the Dodd-Frank Act.

Since it does not belong to the United States, it is not necessary to clear the above regulations, but since it is licensed by the financial authorities of other countries, it is a reliable broker as it is.

However, these brokers also withdrew from the US market one after another.

Why So Many Brokers Has Stopped Their Business in the US Market?

There is one more point.

It is the “Anti money laundering Prohibition Law”.

As you remember, in 2014, France’s BNP Paribas Bank was ordered by the US Justice Department to pay sanctions.

That amount is $ 8.9 billion.

The United States prohibits funding of sanctioned countries (Iran, North Korea, etc.) by law.

BNP Paribas has a deal with Iran and has been sued by the US Department of Justice.

This case is also said to have led offshore brokers to decide to withdraw from the US market.

Withdrawn offshore brokers are afraid of US sanctions and refuse to accept residents living in the United States, regardless of their country of origin.

In the unlikely event that a customer’s deposits flow into a sanctioned country, a tremendous amount of sanctions will be imposed.

As a result, the number of forex brokers operating in the United States has dropped sharply, and so-called offshore brokers have also withdrawn from the US market one after another, making it a little difficult for American residents to start forex trading.

Some offshore brokers still accept American residents, but unfortunately some brokers are undeniably illegal. I have to say that asset management is not done properly and it is very risky to use.

Reliable Forex Brokers that Accept US Residents

According to the Dodd-Frank Act, in principle, when conducting FX brokerage business in the United States, you must obtain NFA (National Futures Association) or CFTC (Commodity Futures Trading Commission), which is a license of the US financial authorities.

There is no problem if the broker clears these regulations.

Even if an offshore broker, if that broker has a track record of accepting US residents and has a good reputation, I think it is possible to specify the risk to some extent.

Of course, it is your own risk, so please judge by yourself.

As far as I’ve researched, following brokers that accept US residents are reliable to use.

*NBP : Negative Balance Protection System

| Broker | Rating | Regulatory | Spreads /Fees | Products | Support | NBP | Bonus Program | Detail |

|---|---|---|---|---|---|---|---|---|

Just2Trade | [jinstar5.0 color=”#ffc32c” size=”14px”] |  |  |  |  | ✔ | ✔ | Detail |

FXChoice | [jinstar4.0 color=”#ffc32c” size=”14px”] |  |  |  |  | ✔ | ✔ | Detail |

LQDFX | [jinstar3.5 color=”#ffc32c” size=”14px”] |  |  |  |  | ✔ | ✔ | Detail |

Let’s take a look at the characteristics of each broker.

Forex Brokers Overview and Review

Just2Trade

Just2Trade is the most recommended broker.

It is NFA regulated broker in the United States and is extremely reliable.

(NFA Regulation No.0430385)

Also, the spreads are very narrow and well worth the long term.

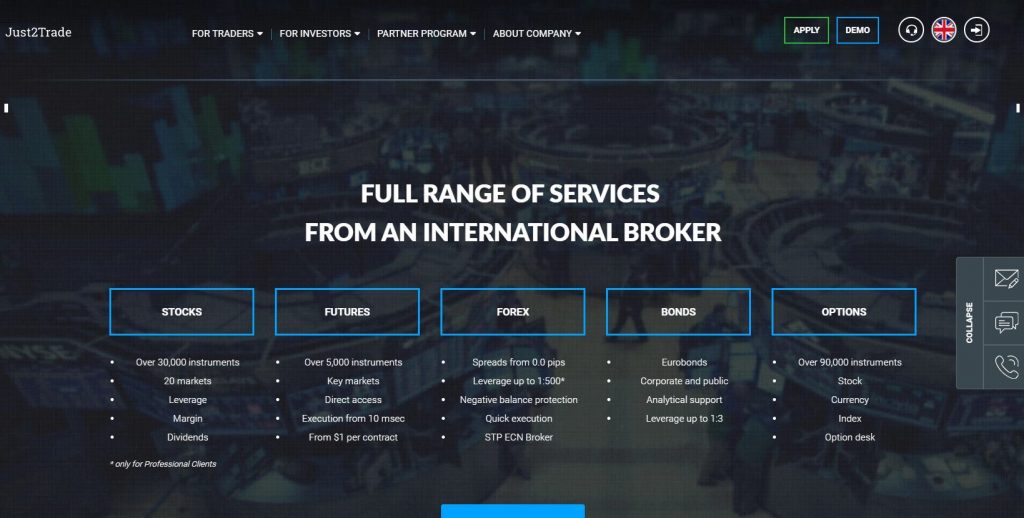

Overview of Just2Trade

| Company | Just2Trade Online Ltd. |

| Established | 2006 |

| Regulated by | NFA(0430385), CySEC(Cyprus) |

| Max Leverage | 1:500 |

| Spreads *STP/Avg. | 0.5pips/EURUSD、0.5pips/USDJPY |

| Commission *ECN | $6/lot |

| Products | Forex:50, CFD:20+, Crypto:5, Stocks:9000+ |

| Account Types | 3 Types (Standard, ECN, MT5 Global) |

| Bonuses | 1 Type (Deposit) |

| Negative Balance Protection | Yes |

| Stop Out | 50/100% |

| Deposit & Withdrawal Fees | Free |

| Support | Phone, E-Mail, Chat |

| Platform | MT4, MT5, CQG |

Just2Trade Advantage & Disadvantage

- Regulated by NFA

- Very narrow spreads

- A lot of products, especially stocks (9,000+)

- 24/7 Support

- Offers bonus program

- Withdrawal fees charged on some payment methods

Just2Trade Account Types

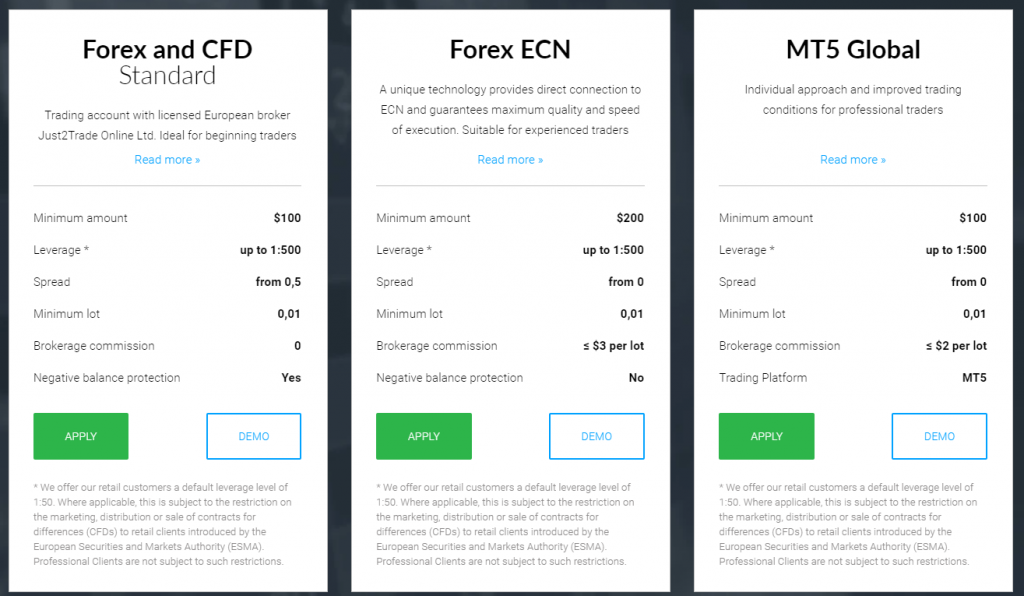

Just2Trade has three types of accounts.

MT5 Global is for traders who make large-scale transactions.

I think the average trader will choose Standard or ECN.

Recommended is Standard.

Spreads are very narrow compared to other brokers and you can trade with low cost.

The transaction fee for ECN account is $ 6 round trip, but it’s not that cheap.

Therefore, I highly recommend the Standard account.

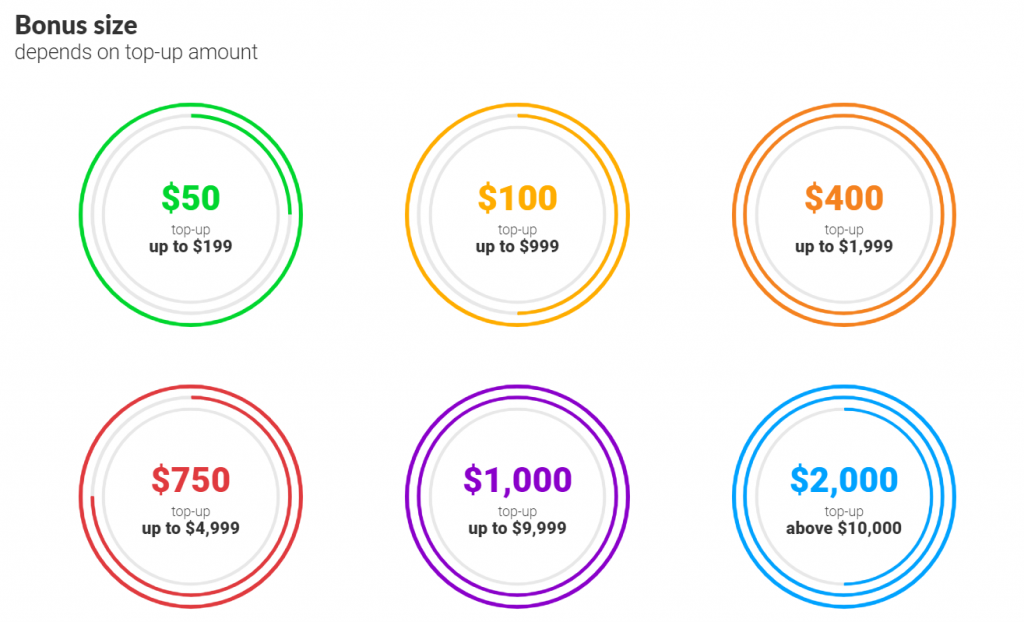

Just2Trade Bonus Programs

Just2Trade offers a bonus program.

Bonus will be given according to the deposit amount.

10-20% of your deposit will be given as a bonus, with a maximum of $ 2,000.

If you use it well, you can aim for bigger profits with less capital.

Just2Trade Conclusion

Just2Trade offers 24/7 support.

They also offer a bonus program, so even beginners can use it with confidence.

Just2Trade is the NFA-regulated and reliable broker.

\Just 3 minutes!!/

FXChoice

FXCoice is not US licensed, but is IFSC licensed and accepts US residents.

Spreads aren’t too narrow, but they’re not badly rated by traders and I think they’re an option for US residents.

Overview of FXChoice

| Company | FX Choice Limited |

| Established | 2010 |

| Regulated by | IFSC(Belize) |

| Max Leverage | 1:200 |

| Spreads *STP/Avg. | 1.7pips/EURUSD、1.4pips/USDJPY |

| Commission *ECN | $7/lot |

| Products | Forex:36, CFD:47, Crypto:3 |

| Account Types | 2 Types (Classic, Pro) |

| Bonuses | 1 Type (Loyalty Program) |

| Negative Balance Protection | Yes |

| Stop Out | 15/25% |

| Deposit & Withdrawal Fees | Yes |

| Support | Phone, E-Mail, Chat |

| Platform | MT4, MT5 |

FXChoice Advantage & Disadvantage

- Regulated by IFSC

- 24/5 Support

- Can trade cryptocurrency

- A lot of funding method

- loyalty Program

- Funding fees are not free

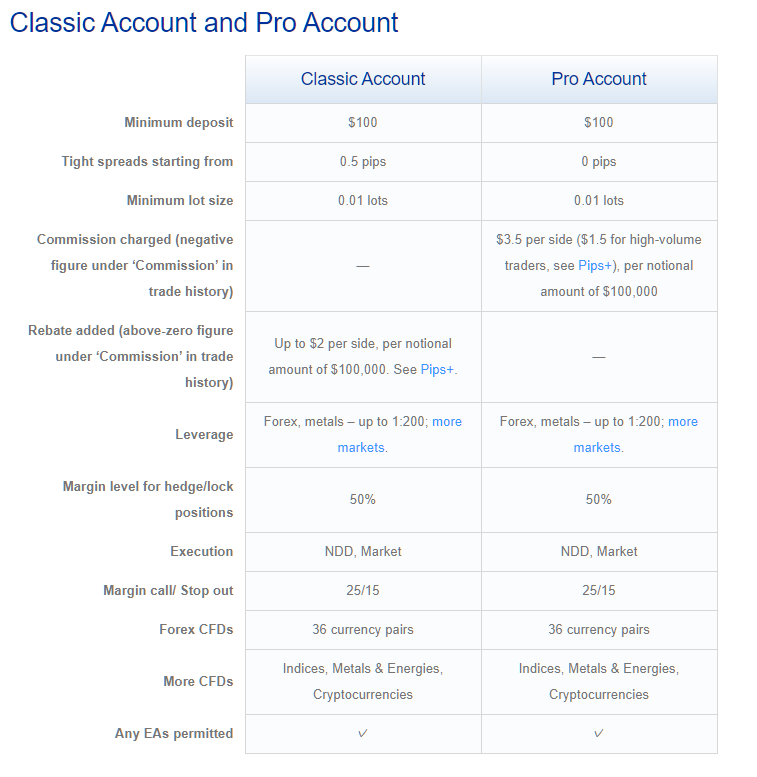

FXChoice Account Types

There are two types of FX Choice accounts.

Classic is a standard account and Pro is an ECN account.

Even with an ECN account, the minimum deposit requirement is not as high as $ 100.

If you are uncertain about your choice, you should choose a Classic account.

Accounts can be opened in USD, EUR, GBP, AUD, CAD, Gold, Bitcoin, Bitcoin Cash, Litecoin, Ethereum and XRP.

It’s very unique.

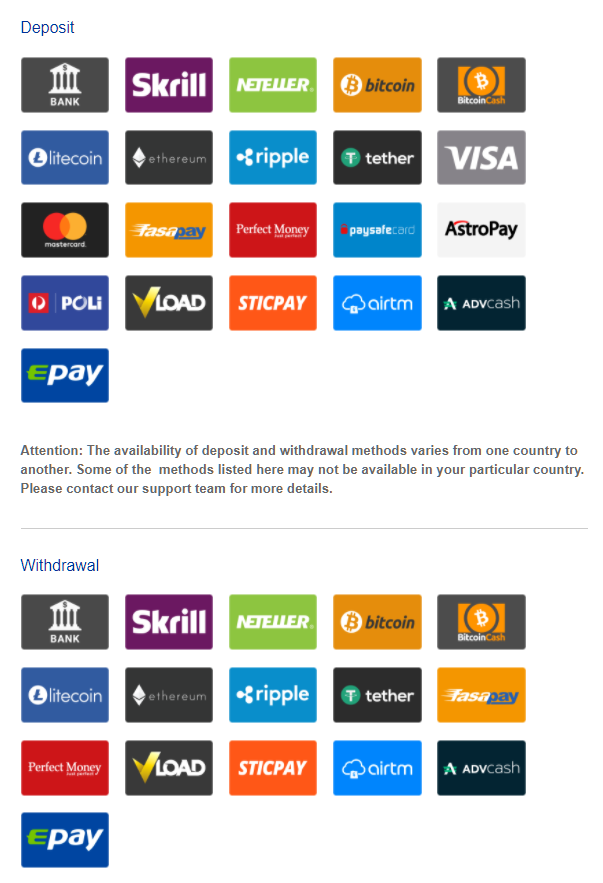

FXChoice Deposit & Withdrawal

FXChoice offers a variety of deposit and withdrawal methods.

Please choose the most convenient method for you.

Fees are free in principle. This is very helpful to us.

Deposit and withdrawal methods vary depending on the country in which the trader lives.

Please check the official website for details.

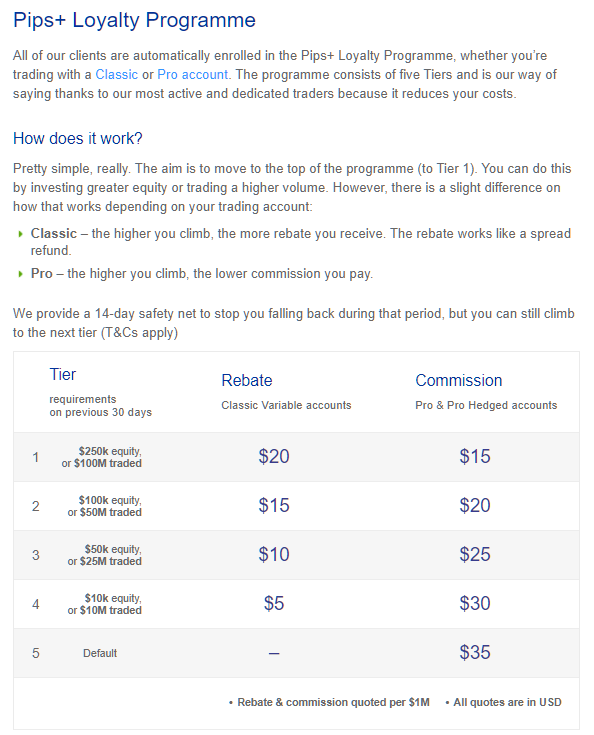

FXChoice Pips+ Loyalty Programme

FXChoice offers a very unique program.

“Pips + Loyalty Program”.

Depending on the amount of Equity and the volume of transactions, the benefits you will get will increase.

If you have a Classic account, you can receive a rebate (cash back) according to the transaction volume.

For Pro accounts, transction fees will decrease as the transaction volume increases.

For any account, the more Equity you have and the more you trade, the more profit you will get.

FXChoice Conclusion

FXChoice is not US licensed, but accepts US residents.

FXChoice offers a support 24 hours a day on weekdays and a unique loyalty Program.

The trader’s reputation is high and I think it can be an option.

\Just 3 minutes!!/

LQDFX

LQDFX is also a broker that accepts US residents, but as of October 2020, it is not licensed in any country.

However, it is a broker with a relatively high reputation from traders. Spreads are narrower than other brokers.

Since it was founded in 2015 and has a relatively short history, I guess that LQDFX will accumulate a track record and obtain approval in the future.

Please make your own judgment in consideration of risks.

Overview of LQDFX

| Company | LQD Limited |

| Established | 2015 |

| Regulated by | N/A |

| Max Leverage | 1:500 |

| Spreads *STP/Avg. | 1.2pips/EURUSD、1.2pips/USDJPY |

| Commission *ECN | $7/lot |

| Products | Forex:70+, CFD:35+ |

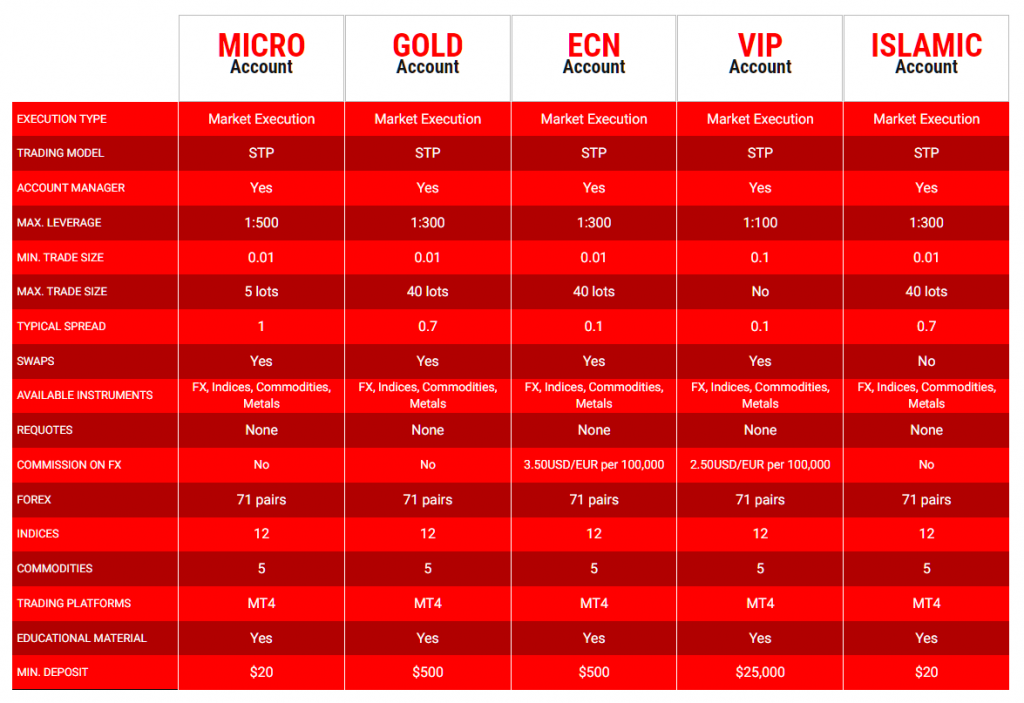

| Account Types | 5 Types (MICRO, GOLD, ECN, VIP, ISLAMIC) |

| Bonuses | 1 Type (Deposit Bonus) |

| Negative Balance Protection | Yes |

| Stop Out | 20/50% |

| Deposit & Withdrawal Fees | Yes |

| Support | Phone, E-Mail, Chat |

| Platform | MT4 |

LQDFX Advantage & Disadvantage

- Very narrow spreads

- Gorgeous deposit bonus up to $20,000

- 24/5 Support

- Funding fees (Credit Card)

- No regulatory

LQDFX Account Types

There are five LQDFX account types.

ISLAMIC accounts are for Muslims.

ECN account fees are normal, at $ 7 round trip per lot.

If you are a general trader, you will probably choose a MICRO account or a GOLD account.

Traders who can afford to prepare large capital should choose a VIP account. The minimum deposit requirement is $ 25,000 and more, but VIP accounts have narrower spreads than ECN accounts despite being STP accounts.

LQDFX Bonus Program

LQDFX offers 100% deposit bonus program.

100% bonus will be given for deposits of $250 and above.

So if you deposit $250, you will get a bonus of $250 and a total margin will be $500.

The maximum bonus amount is $20,000.

This is very gorgeous.

If you deposit $20,000, total margin will be $40,000!

With this deposit bonus, you can aim for bigger profits even with a small amount of money.

LQDFX Conclusion

Again, LQDFX is not licensed in the United States.

However, it offers attractive 100% deposit bonus and is highly rated by traders.

Please evaluate and judge the risk yourself.

\Just 3 minutes!!/

If you are not an US resident

You have a lot of choices.

Please refer to my article ”How to Choose the Best Forex Broker for You” to know what kind of broker is suitable for you.

And choose a good forex broker.

Summary

The United States is the most financially regulated country in the world.

Some US residents who want to start forex trading are in trouble to find a broker , and even if they could find a broker, but they can’t decide whether it is a scammer or not.

Brokers with NFA regulatory are perfectly fine.

Even if a broker is not regulated by NFA, you can fully evaluate the risk and use it at your own discretion.

Please refer to my article and find a good broker.

コメント