Forex trading is said to be suitable for second jobs.

I think there are some people who were originally a little interested in investing, and recently started investing in stocks and Forex.

In this article, I will explain why Forex is suitable for second jobs, the advantages and disadvantages of Forex trading, and how to get started.

- Why Forex is suitable for second job

- Advantage and disadvantage of Forex side job

- What kind of person is good for Forex trading?

- How to start Forex

- What is “Forex”?

- Why Forex trading is suitable for second job?

- Advantages and disadvantages of Forex as a second job

- It’s not labor so you don’t have to trade if you don’t want to trade

- Being interested in and checking economic news around the world that affect the market

- You can start with a small fund

- You can trade not only during the day but also at night, you can trade even after work

- You can make big profits by taking advantage of leverage

- May cause loss

- What kind of person is good for Forex trading?

- Reasons to recommend Forex

- How to start Forex trading

- Recommended articles for those who are about to start Forex

- The Best Forex Brokers | Review and Ranking

- [For Beginners] How to Choose the BEST Broker for you?

- The Best Forex Bonus Ranking

- Low Spread Forex Brokers

- What is Forex Trading Hours?

- Forex Broker | Products Comparison Review

- Best Forex Brokers for Crypto Trading

- Deposit and withdraw with Credit / Debit Card | Basic mechanism

- Forex Brokers that Accept US Residents and US Citizens

- Summary

What is “Forex”?

Let’s start with the basics.

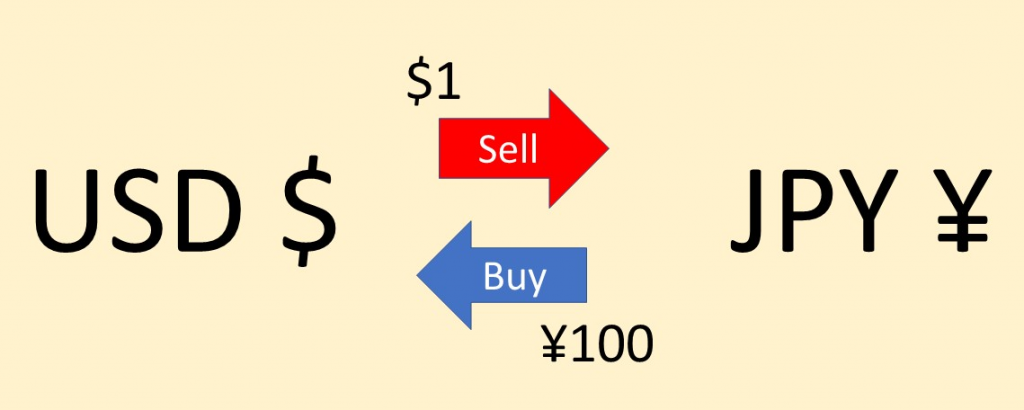

Forex is an abbreviation of “Foreign Exchange”.

Forex is a transaction in which opposing products are exchanged.

Forex usually means currency pairs.

As the name implies, a currency pair is a combination that exchanges the currencies of each country.

For example, Euro US dollar (EUR/USD), US dollar Japanese Yen (USD/JPY).

There are various currency combinations, and there are over 100 types.

In addition, Forex brokers offer a large number of “CFD” products.

CFD is “Contract For Difference”, which means that you trade the difference in trading price without actually exchanging.

CFD include crude oil, precious metals such as gold and silver, futures commodities such as wheat, stock indexes and so on.

These products are traded with currencies such as the US dollar (USD).

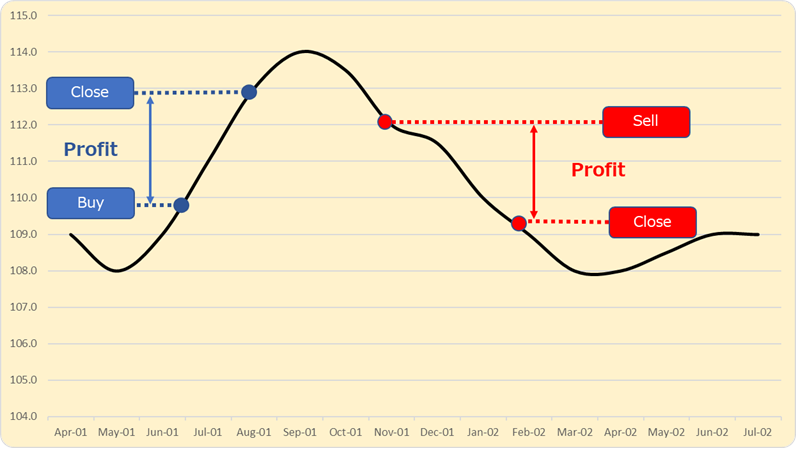

For both Forex and CFDs, trading starts with a “Buy” or “Sell” order.

If you enter with “Long (Buy)” and the price goes up, you can take profit by closing that position.

If with “Short (Sell)” and the price goes down, you can take profit.

If the price moves in the opposite direction, it will be a loss.

As you understand now, Forex is transactions that focus on the exchange value between currencies or between currencies and various commodities, and aim to make a profit from the price difference caused by the difference in trading timing.

For details on what kind of products are offered in Forex brokers, please refer to the separate article “Forex Broker | Products Comparison Review“.

Why Forex trading is suitable for second job?

There are several reasons, but I think:

- Easy to get started

- Can start with a small amount of money

- Can be traded even on weekday nights

- No need to spend long time with the chart

Easy to get started

When you think about second jobs, you can do establishing a company individually, writing books and blogs, and recently being Youtuber, but all of them are not easy to start, and not easy to keep on.

Getting started with Forex is very easy.

All you have to do is open an account with a Forex broker, deposit and trade.

Depending on the broker, if you want to get started, you can trade from the same day.

Can start with a small amount of money

Forex is a type of investment, but it does not require millions or tens of millions of dollars.

You can start from around $100.

Forex funds are called margin, but of course, the more margin you have, the bigger the trade you can make, so when you can trade as you expected, you will get bigger profits.

On the other hand, if you trade big, you may lose a lot.

I recommend trading in low lots with a small amount of money at the beginning.

Leverage is a mechanism that allows you to trade more effectively even with a small amount of funds.

Furthermore, if you utilize the bonus provided by the Forex broker and the negative balance protection system unique to the Forex broker, you can trade with less risk.

This will be discussed later.

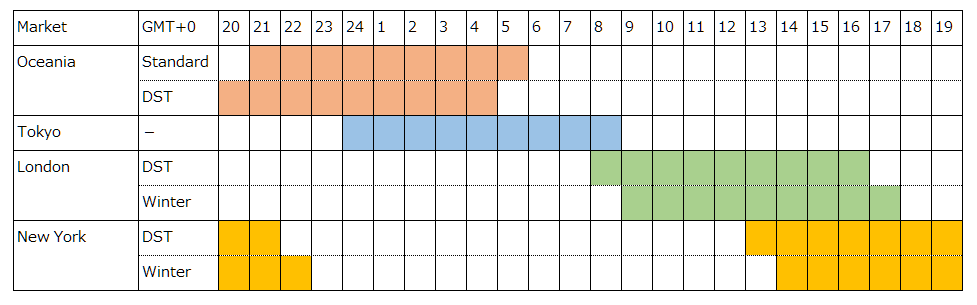

Can be traded even on weekday nights

Forex can be traded 24 hours a day on weekdays.

This may be the biggest reason why people who are full time worker are suitable for side jobs.

Forex is a trade that does not have a physical exchange.

The major markets will open in order, starting with the date change, Oceania, Tokyo, London and New York.

By the time the New York market closes, the Australian and Tokyo markets will open again.

Depending on where you live, you can trade in your free time, which does not overlap with your main work time.

Forex trading hours and the characteristics of each market are summarized in a separate article “What is Forex Trading Hours?“, so please see here for details.

No need to spend long time with the chart

This is one of the major misconceptions about Forex.

Whe you do Forex trading, you look at the chart, do analyze, think about trading strategies, and place orders (sell, buy) at the right timing.

If the price moves as you expected, you will settle (close the position) and make a profit when the price reaches the decided price.

On the contrary, you may close the position with loss if the price moved opposite direction.

Prices do not always move in one direction, move up and down repeatedly.

So even if you make a profit, it can take minutes, and sometimes days, to reach your target price.

It’s easy to misunderstand, but you don’t have to look at the chart all the time.

You don’t need to stick to chart so long time.

There are many types of order method.

You can set take profit and stop loss settings.

You can place reservation order that will be done by price condition.

In other words, you don’t have to stick to the charts for hours by having a good pricing strategy in advance.

Of course, there is also a method of trading aiming for small price movements within a few minutes. (It is called “Scalping” trading.)

In this case, for example, it is common to decide the time zone and concentrate on trading for these 3 hours, or to decide the time zone in advance and trade.

Otherwise, if you stick to the chart and trade every day until the morning when the market closes, you cannot work your main job.

Advantages and disadvantages of Forex as a second job

The advantages and disadvantages of considering Forex as a second job are as follows.

- It’s not labor so you don’t have to trade if you don’t want to trade

- Being interested in and checking economic news around the world that affect the market

- You can start with a small fund

- You can trade not only during the day but also at night, you can trade even after work

- You can make big profits by taking advantage of leverage

It’s not labor so you don’t have to trade if you don’t want to trade

Forex is not labor.

You don’t have to trade every day.

Trading is not your duty.

You don’t have to trade when you’re tired, not in mood to trade, have other errands.

If the market does not move as expected, or if the price movement is too violent and the risk is high, there is no need to force a trade.

You can enter only when you want to trade.

Thinking this way, this makes you feel ease.

Being interested in and checking economic news around the world that affect the market

This is a side effect, but I personally think it’s a huge benefit.

Prices fluctuate depending on products such as currency pairs and CFDs, as well as political and economic trends.

When you are doing Forex trade, you will inevitably become interested in such news and check it.

I’m sure this will be useful for your work as well.

It’s an exaggeration to say, but I feel that such a broader perspective will enrich our life a little.

You can start with a small fund

As mentioned above, you can start with a fund of about $100.

With the Forex brokers that I introduce, you can get a bonus of $30 to $100 just by opening an account, and you can start trading without deposit your money.

Since you do not deposit, you can start trading without risk.

This is one of the big advantages.

You can trade not only during the day but also at night, you can trade even after work

As mentioned above, Forex market open 24 hours a day.

You can set the trading time according to your main work time zone.

If you have holidays on weekdays, you can trade day-time of weekdays.

If cryptocurrency trading popular recently, you can trade 24 hours a day including Saturday and Sunday.

You can make big profits by taking advantage of leverage

If your trading strategy is successful, you can make big profits.

By taking advantage of leverage and bonuses, it is possible to reduce risk and aim for larger profits even with a small amount of funds.

- May cause loss

May cause loss

The disadvantage is that you may lose money.

If it is a reward for labor, it will never be negative, but in the case of Forex, you may lose funds.

What kind of person is good for Forex trading?

Forex is suitable for such people.

- Those who can trade calmly without getting too heated

- Those who are interested in the economy and politics of the world

- Those who can study FX by working hard

Forex is by no means gambling.

However, there are only two types of Forex, one price goes up or the other price goes down, so it has the image of a gambling.

There are reasons for prices to go up and down.

You need to study hard, gather information, think why it happens, analyze market, establish your method, and trade.

Even if you continue to lose, even if you play a big game with the aim of reversing one shot without any grounds, you will surely lose again.

Forex is suitable for those who can always trade calmly and those who are good at studying and collecting information.

Reasons to recommend Forex

To trade Forex, you first need to open an account with a Forex broker.

Forex brokers have the following characteristics, and by utilizing these, it is possible to trade with less risk with less funds.

- Can aim for big profits with a small amount of funds by utilizing high leverage trading

- Negative balance protection system eliminates the need for margins and does not result in debt

- Gorgeous bonus programs

The biggest feature is Negative Balance Protection (NBP) system, even if you meet the stop out and the margin becomes negative, the balance will be reset to zero and you will not be in debt.

Regarding NBP, I have summarized the story I actually experienced in another article “Negative Balance protection System | The True Story that Saved Me“, so please have a look.

How to start Forex trading

How do you get started with Forex?

Those who have no idea what to do first or what to prepare.

Simply put, you can start Forex trading by following the steps below.

- Choose a Forex broker

- Open an account

- Make a deposit

- Trade

①Choose a Forex broker

First, select a Forex broker you use.

There are many Forex brokers in the world, and some of them are fraudulent, so you need to determine the safety and select a broker with better trading conditions that suits your trading style.

If you are a beginner, you will probably stumble here first.

To choose a Forex broker, please refer to the separate article “[For Beginners] How to Choose the BEST Broker for you?“.

I introduce the criteria for selecting a Forex broker, the reason, and the recommended brokers evaluated according to the criteria in a ranking format.

②Open an account

After deciding a Forex broker, open an account.

Opening an account is completed in a few minutes.

After that, upload the image of your driver’s license and so on and verify your identity.

This is the same in any forex broker.

The detailed account opening procedure of each Forex broker that I introduced is explained with screen shots in articles “How to open an account in forex broker“.

In addition, each broker offers various account types, and each broker has different trading conditions.

This is also explained in detail in “Account types of each broker“, so please refer to it as well.

③Make a deposit

After opening an account with a Forex broker, deposit to your account.

For deposit, various deposit methods such as bank transfer, credit card deposit, bitwallet and cryptocurrency are provided.

For a list of deposit methods and fees of each Forex broker and recommended deposit methods, see separated articles “Deposit methods of each broker” in detail.

④Trade

After depositing, it’s time to trade.

Make a solid strategy and make a reasonable trade.

Recommended articles for those who are about to start Forex

This article is recommended for those who want to start Forex and open an account.

Please refer to these and select the most suitable Forex broker that suits you.

The Best Forex Brokers | Review and Ranking

It is a summary article of Forex brokers reviews evaluated based on general evaluation criteria.

If you know some names of Forex brokers, you can easily know the characteristics of each broker in this article.

[For Beginners] How to Choose the BEST Broker for you?

This is a commentary article especially for beginners.

For those who are starting Forex trading, I am picking up the criteria to be evaluated and it’s reasons, and the Forex brokers that I am actually using and can be recommended to beginners.

I think this article is the easiest to understand for beginners.

The Best Forex Bonus Ranking

Forex brokers offer various very attractive bonus programs.

I explain each bonus program of Forex brokers in detail, and introduce them in ranking format in order of recommendation in each type of bonus.

Some brokers can get an account opening bonus and start trading immediately without depositing, and some brokers can get a deposit bonus of up to $20,000.

Bonuses allow you to increase your margin without risk, and you can withdraw the profits you earn.

There is no reason not to use it.

Low Spread Forex Brokers

There is a fee for trading regardless which broker, I compared with all of forex broker trading cost and I am introducing recommended brokers in the ranking format.

This article also provides a basic explanation that is useful for beginners, such as what spreads are, why spreads vary by broker and brand, and trends depending on trading hours.

Please take a look.

What is Forex Trading Hours?

As mentioned above, Forex can be traded 24 hours a day on weekdays, but why is that so?

This article also provides basic explanations such as market trends by time zone and points to note when trading.

In addition, depending on the product, it may be necessary to pay attention to the trading time.

In this article, the trading time of each Forex broker is organized in a list, and the detailed method of checking the trading time of each Forex broker is also summarized in another article.

Forex Broker | Products Comparison Review

Forex brokers offer a lot of very attractive products.

As for currency pairs, brokers handle all major currency pairs, but minor currency pairs called “exotic currencies” are handled only by a limited number of brokers.

In addition to currency pairs, brokers offer various products and stocks such as stock indexes of stock exchanges of each country, recently popular gold, crude oil and commodity futures, bonds, ETFs, individual stocks, etc.

One of the criteria for choosing an Forex broker is whether or not the broker offers products you have traded.

Before opening an account, please check if there is products you want to trade.

Best Forex Brokers for Crypto Trading

From 2020, the cryptocurrency trading boom is happening again.

Actually, some Forex brokers offer crypto trading such as Bitcoin and Ethereum.

Moreover, unlike cryptocurrency exchange company, it is not a physical transaction, it’s a cryptocurrency CFD, so you can also perform high return trading that makes use of high leverage.

In this article, I am introducing Forex brokers that can trade cryptocurrencies, and explain which cryptos can be traded and trading conditions as well.

Please refer to those who want to trade cryptos.

Deposit and withdraw with Credit / Debit Card | Basic mechanism

In order to deposit to the account opened in the Forex broker, deposit using a credit card is very common.

In this article, I explained from the basics, such as what kind of mechanism it is to deposit with a credit card or debit card, what precautions to take and so on.

In addition, the card brands (VISA, Mastercard, etc.) accepted by each Forex broker are also listed.

Forex Brokers that Accept US Residents and US Citizens

If you are a resident of the United States, only a limited number of Forex brokers that you can open an account.

A lot of forex brokers do not accept US residents. Only a limited number of brokers accept US residents, due to the Dodd-Frank Act.

See this article if you want to know which Forex brokers are accepting US residents and recommended .

Summary

The above is an explanation of why Forex is suitable for second job, its advantages and disadvantages, and how to start Forex.

Again, forex is easy to get started with, but it’s easy to lose money if you make unreasonable trades.

Minimize the risk as much as possible, start with a small lot at first, and gradually get used to Forex.

It is also necessary to check economic news daily and study trading methods.

Either way, you can do it all at your own pace and in your spare time.

It’s a very attractive second job where you can use your time freely and hopefully aim for big profits.

コメント