This is an article explaining the leverage of iFOREX.

The maximum leverage of iFOREX is 400x.

This in itself is a normal level for forex broker, but as it turns out, iFOREX has the following features and you need to be careful when managing leverage.

- iFOREX does not allow you to change leverage

- iFOREX does not allow you to create additional accounts (you cannot diversify your funds)

Just because you cannot change your leverage does not mean you must always trade with high risk.

I will also explain some tips on how to trade with iFOREX while considering high leverage.

In this article, I will explain what leverage is for beginners, the maximum leverage and leverage limits of iFOREX, and how to manage risk with less risk.

- What is the leverage?

- What is the maximum leverage of iFOREX?

- Leverage limits of iFOREX

- How to manage risks

What is Leverage?

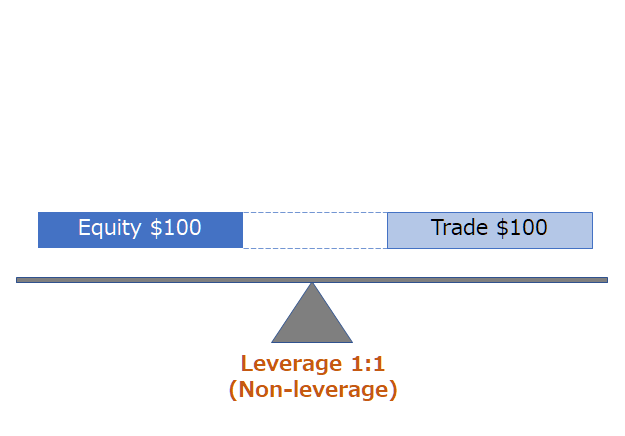

Leverage means the principle of leverage.

Using the principle of leverage, you can lift a large stone with a small power.

In the forex world, it refers to a system that allows you to make large trades with a small amount of margin (money).

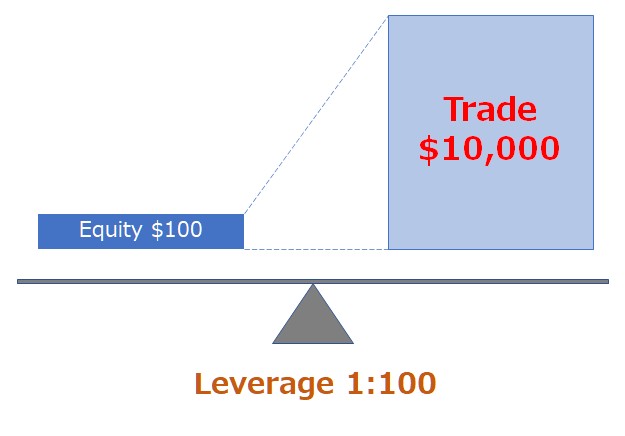

Leverage is often expressed as “100 times”, “100x” or “1:100”.

In the case of 100 times leverage, it is possible to trade 100 times the amount of margin.

If your margin is $100, you can trade $10,000.

A $100,000 margin allows you to trade $10,000, and a $100,000 margin allows you to trade $10,000,000.

Differences in Required Margin due to differences in leverage

The Required Margin can be calculated using the following formula

Required Margin = Number of lots × Market price ÷ Leverage

Let’s calculate exactly how much the required margin changes with different leverage.

For example, let’s assume the following trade

Currency pair: EURUSD

Number of trades: 1 lot (=100,000 currency)

Market price: 1 EURO = 1.200 USD

100,000 EUR × 1.200 ÷ 1 = 120,000 USD

100,000 EUR × 1.200 ÷ 100 = 1,200 USD

100,000 EUR × 1.200 ÷ 400 = 300 USD

Thus, if you take advantage of iFOREX maximum 400x leverage, you can trade 100,000 Euros for only $300.

Trading leverage at iFOREX

The maximum leverage of iFOREX is 400x, actually not all products can be traded at 400x at any given time.

iFOREX offers one account type

Some Forex brokers offer several different account types, and each account type may have different maximum leverage.

iFOREX offers only one account type.

This means that everyone who creates an account with iFOREX can trade with a high leverage of 400x.

No restrictions based on account balance

Some forex brokers automatically limit the leverage depending on the account balance (margin balance) or trade volume.

At iFOREX, there is no leverage limit based on account balance or trade volume.

Depends on the trading instrument

iFOREX is famous for the wide variety of stocks it offers.

You can trade not only currency pairs and major CFDs, but also CFDs on cryptocurrencies and ETFs.

In addition, iFOREX offers an overwhelming number of individual stocks, with over 800 individual stocks alone.

In fact, only currency pairs can be traded at the maximum leverage of 400x on iFOREX.

For other products, the maximum leverage is set lower in consideration of the characteristics and volatility of the products.

| Products | Max Leverage |

|---|---|

| Currency Pair | 1:20~1:400 |

| Stock Index | 1:20~1:200 |

| Energy | 1:66~1:100 |

| Metal | 1:100~1:200 |

| Commodity | 1:50~1:100 |

| Cryptocurrency | 1:5~1:13 |

| Stocks | 1:20 |

| ETF | 1:13~1:40 |

All of iFOREX products and the maximum leverage that can be traded with each of them are explained in detail in the separate article “iFOREX All Products and Trading Conditions | Forex and CFDs“. Please take a look.

Recommended operation

Especially in the world of forex, people focus on the high leverage, but the higher leverage is not the better.

Leverage is a double-edged sword.

If you trade a product with high volatility with full leverage, a small price reversal will result in an immediate loss.

This is not a recommendation, but rather a principle of leveraged trading.

- Follow strictly the money management rules

- Understand the margin requirements and the amount per pips

- Adjust the number of lots and leverage

When you increase the leverage, the amount of fluctuation per pips becomes larger.

It is necessary to decide beforehand how much you can bear in case the price moves against your expectations. After properly planning your trading strategy, prepare sufficient funds and decide on the number of lots to order.

At this time, you can also change the leverage in advance to reduce the risk of loss cutting in case of unexpected price movements.

This means that rather than operating with 1000 times leverage, you can reduce the risk to one tenth by using 100 times leverage.

Hot to Change Max Leverage in iFOREX?

Actually, iFOREX does not allow you to change the leverage by yourself.

Many other forex brokers allow you to freely set the leverage for each account.

However, iFOREX does not allow you to change the leverage individually.

Even when you open an account, there is no need to specify the leverage.

There is only one account type you can choose at iFOREX, but it is automatically set to a maximum leverage of 400x.

So how do you control the risk?

Basically, the following measures should be taken.

- Lower the number of lots you trade.

- Keep the balance in your account low.

If you order 0.01 lots instead of the usual 1 lot, it is equivalent to increasing your leverage by a factor of 1:4.

In addition to lowering the lot size, it is also effective to keep your account balance low.

iFOREX offers Negative Balance Protection system (aka NBP), which means that even if your account balance becomes negative due to a stop out, it will be automatically compensated.

By keeping your account balance low, you can reduce the amount of loss-cutting in case of emergency.

However, if your account balance is too low, you may face a loss cut due to too low a balance, when you would have been able to withstand a return in price. How much you should keep in your account depends on what products you trade and with what strategy.

The stop out level of iFOREX is 0%.

This means that you will have to endure until your margin balance reaches zero, just barely.

High-risk trading is not everyone’s cup of tea, but there are traders who use iFOREX who prefer to trade high risk and high return, taking full advantage of the high leverage of 400x fixed leverage, 0% stop out level, and the NBP system that does not chase debts when the time comes.

Summary

I hope you enjoyed the article.

In iFOREX, not all products can be traded with 400x leverage.

Also, since you cannot change the leverage setting, you need to plan your trading strategy more carefully, including the number of lots and stop loss settings.

On the contrary, you can take advantage of the characteristics of leverage to aim for larger profits while reducing risk.

Please make sure you understand leverage properly and operate it as safely as possible.

\Just 3 minutes!!/

コメント