There was a cryptocurrency boom in 2017.

It is said that all young people who had no investment experience before started trading cryptocurrencies.

Some people used to become millionaires with cryptocurrencies.

But unfortunately, the value of cryptocurrencies will not be tens to hundreds of times higher than it used to be.

On the other hand, it can be said that cryptocurrency trading is suitable for short-term trading such as Forex.

The mechanism is the same as forex trading. Like FX currency pairs, cryptocurrencies also have pairs. The way of trading is exactly the same.

In some of the forex brokers I introduce can trade cryptocurrencies.

In my opinion, forex brokers are more advantageous and safer than crypto brokers when trading cryptocurrencies.

This is because forex brokers can aim for large profits with a small amount of funds with high leverage.

In this post, I will explain about;

- For those who are currently trading or want to do cryptocurrency trading

- What is cryptocurrency, what is a crypto trading

- Difference between crypto broker and forex broker

In the last, I would like to introduce forex brokers that can trade cryptocurrencies.

Let’s get started.

What is Cryptocurrency?

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange wherein individual coin ownership records are stored in a ledger existing in a form of computerized database using strong cryptography to secure transaction records, to control the creation of additional coins, and to verify the transfer of coin ownership.

Wikipedia

It is called virtual currency or cryptocurrency.

Sometimes it is called Crypto for short.

The opposite of cryptocurrencies is the money we usually spend.

Let’s call it real currency.

The value of real currency is 1 yen for 1 yen and 1 dollar for 1 dollar. Snacks priced 100 yen will be exchanged for 100 yen. Prices will fluctuate in the long time, but the value of 100 yen as a currency does not change that much.

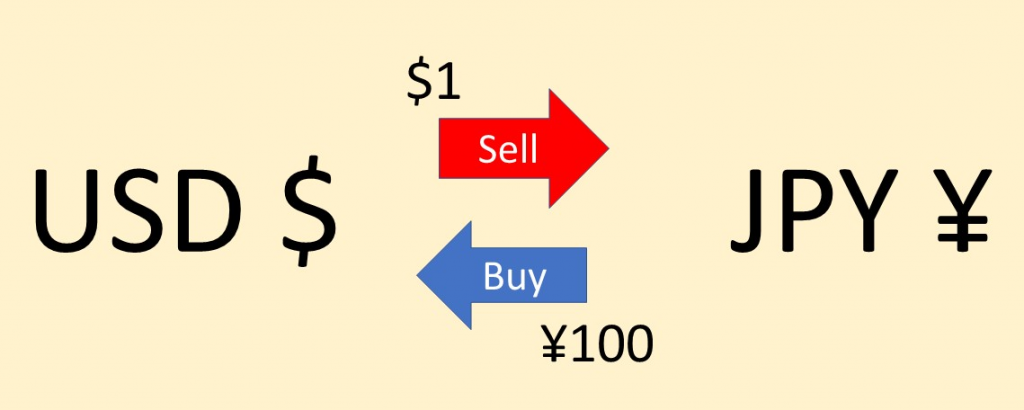

On the other hand, suppose you want to exchange real currencies.

If you exchange dollars for yen, 1 dollar = 100 yen or 120 yen. Price will be changed often.

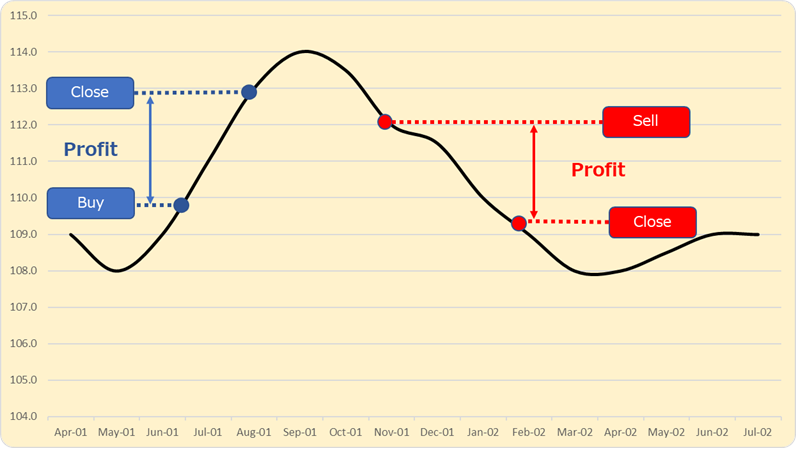

The mechanism of Forex trading is to make a profit from the difference in value exchange between currencies, more specifically, the price difference caused by the difference in the time axis of trading timing.

This mechanism is the same for cryptocurrencies.

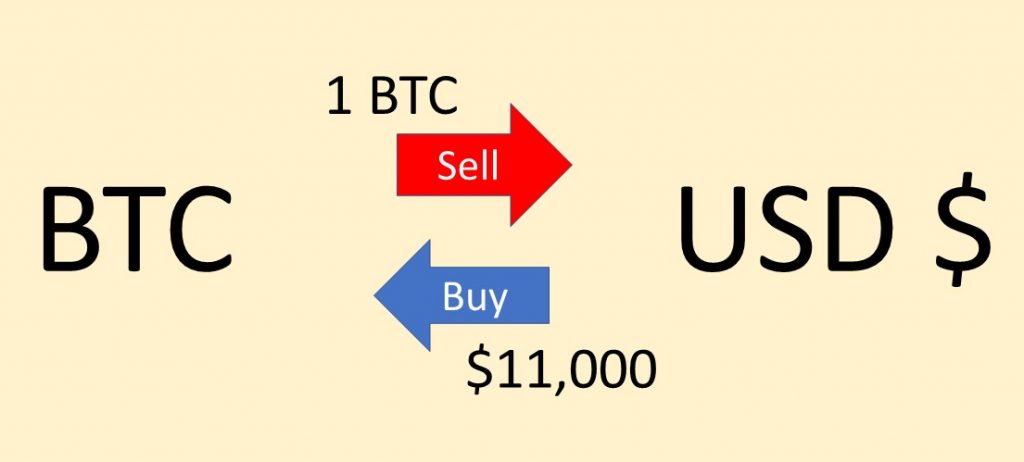

For example, you can exchange Bitcoin for dollars and make a profit from the price difference.

It is exactly the same as Forex trading.

The difference is that the price of cryptocurrencies fluctuates sharply.

Depending on the cryptocurrency, it may rise / fall by about 30% in one day.

The image is that USD/JPY goes back and forth between 90 yen and 110 yen a day.

This is a fluctuation that cannot be happened on real currencies, but due to the magnitude of this price fluctuation (volatility), cryptocurrencies are also popular as short-term trading targets.

Well, isn’t virtual currency expected to increase many times?

I’m sure there are people who think that.

Unfortunately, that era is over.

Millionaire is No Longer Born

As I wrote at the beginning, there was a cryptocurrency boom in 2017.

I don’t remember what triggered it, but it’s true that everyone started investing in cryptocurrencies. It was around this time that cryptocurrency brokers appeared more and more.

As you know, the pioneer of cryptocurrencies is Bitcoin (BTC).

Since its inception in January 2009, Bitcoin has continued to rise steadily until 2017.

As of October 2020, it is valued at around $ 11,000 per BTC, but when it was born it was $ 0.001.

Someone who was curious and bought some when the price was still quite low, the value went up and he got hundreds of millions of dollars.

Bitcoin hit a record high of about $ 20,000 in 2017. Compared to the value at birth, it is 20 million times higher. If someone had bought 100 dollars at that time, it would have been 2 billion dollars. It’s ridiculous.

But in conclusion, I don’t think cryptocurrencies will give birth to millionaires anymore.

The value of Bitcoin itself will fluctuate, but it will not rise as it once did. There is a reason for this, but I will omit it because it will be long. (If you are interested, please search by keywords such as issuance amount, halving, etc.)

So what about other cryptocurrencies? You may think to find a cryptocurrency like Bitcoin and invest in it.

It is said that there are thousands of cryptocurrencies around the world today. No one knows the exact numbers. New cryptocurrencies are born every day.

After a little study of how it works, you will find that creating cryptocurrencies is not that difficult. Therefore, a large amount of new cryptocurrencies are born like this.

What is important is its value exchangeability.

If exchangeable with other currencies is high, then value itself will increase.

As I mentioned earlier, the price will not rise unless the exchange value is high.

I don’t think that cryptocurrencies that satisfy these two will be born in the future.

Even if the cryptocurrency is born, it would be a miracle to find you or it early on, buy it, sell it, and make huge profits.

Cryptocurrency as Currency

As mentioned above, cryptocurrencies are valued by the same exchangeability as real currencies.

On the other hand, cryptocurrency is electronic that exists in the network, and the reality is that it is rarely used for exchanging products such as real currency, especially for use in physical stores. (Of course, there are places where you can use it)

Therefore, the image of “cryptocurrency = investment target” is becoming stronger.

Large price fluctuations (volatility) like Bitcoin also contribute to this.

There is also a cryptocurrency developed for the purpose of stability as a currency.

For example, Tether (USDT).

Tether aims to make one tether almost 1 US dollar, and the number of issued currencies etc. is strictly controlled.

The concept is to make it usable in the same way as the USD as a real currency.

In other words, the investment potential is extremely low. (That’s why there is no tether in the currencies handled by overseas Forex, which will be explained later.)

Recently, I often hear the term CBDC (Central Bank Digital Currency).

This refers to cryptocurrencies issued by the central banks of each country.

Since it is issued by the central bank, it is treated the same as real currency. Issuance volume is also tightly controlled. In principle, the value is exactly the same as the real currency.

In this way, when looking at cryptocurrencies as currencies, they are divided into those that have a strong aspect as investment targets such as Bitcoin and Ethereum, and those that have a strong aspect as a second currency such as Tether and CBDC.

Cryptocurrency as Investment

When viewed as an investment target, cryptocurrencies with large price fluctuations look very attractive as targets for short-term trading.

Large price fluctuations mean that the value exchangeability with the partner currency is high.

Prices fluctuate because there are many people to exchange (sellers and buyers) and there are many opportunities to close a deal.

Conversely, only well-known cryptocurrencies with high exchange value are suitable for such short-term trading.

Bitcoin, Ripple, Ethereum, etc.

In general, cryptocurrency price fluctuations are larger than real currencies.

Therefore, when focusing on this price fluctuation, cryptocurrency is still popular as a target for short-term trading.

The is exactly the same as Forex.

Where Can We Trade Crypto?

You can buy and sell cryptocurrencies on either the cryptocurrency broker or the forex broker.

Although similar, there are major differences between the two brokers.

Cryptocurrency exchanges are mainly spot trading.

Cryptocurrency brokers have a dedicated cryptocurrency account called a wallet.

You can use this wallet to send cryptocurrency to another person’s wallet and receive the sent cryptocurrency from another person as well. Forex brokers do not have this wallet.

Cryptocurrency exchanges cannot be leveraged in the case of spot trading.

It is 1:1 trading.

Imagine exchanging Euro to US dollars at a currency exchange when you travel abroad. It’s the same. There is no concept of leverage, right?

On the other hand, some exchanges allow margin trading. You can leverage with margin trading, but it’s still not so higher.

Forex brokers allow you to trade with high leverage.

Since it is CFD that aims for profit by the difference in the amount of trading, not for the purpose of having the actual item, it is possible to leverage up to 500 times depending on the margin and transaction volume.

| Crypto Broker | Forex Broker | |

|---|---|---|

| Trading | Spot Trading *Margin Trading in some broker | CFD |

| Leverage | 1:1 or very low (Margin Trading) | High (1:10 ~ 1:500) |

| Wallet | ✔ | ✖ |

| Send to others | ✔ | ✖ |

| Receive from others | ✔ | ✖ |

Forex Brokers Offering Crypto Trading

Among the brokers I have introduced, the following 5 brokers can trade cryptocurrencies.

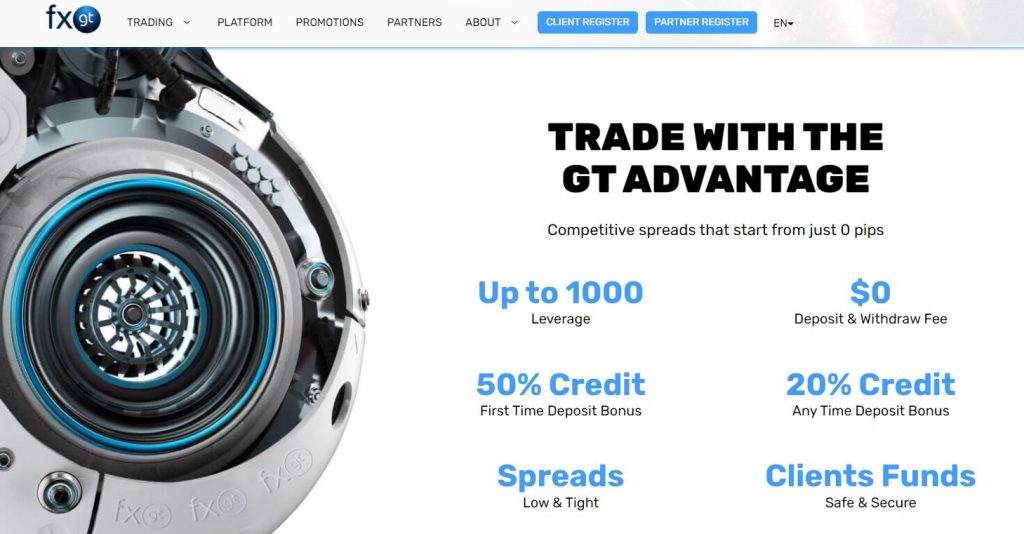

The most famous of these is the FXGT.

Although it varies depending on the trading volume, only FXGT can trade cryptocurrencies with high leverage up to 500 times.

Details will be described later.

| Forex Broker | Cryptocurrencies | Max Leverage |

|---|---|---|

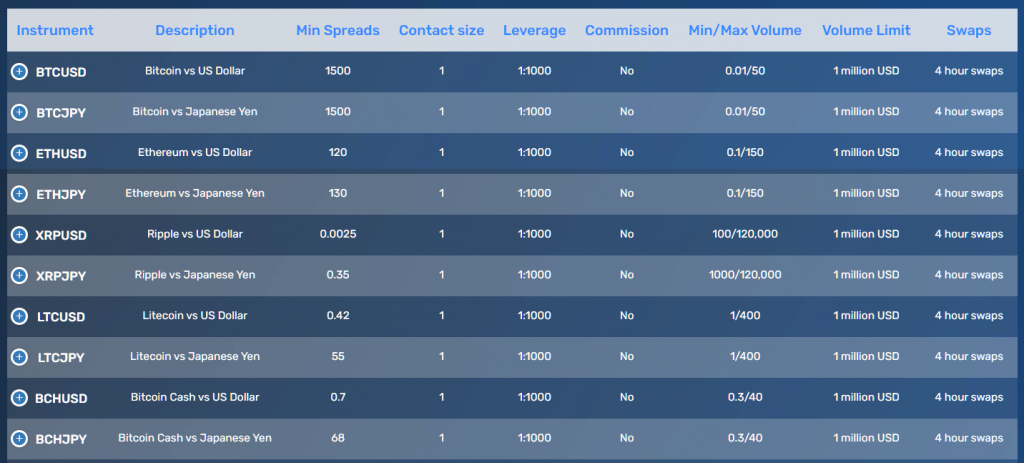

FXGT | 30 Pairs (8 Cryptos) BTC:Bitcoin EHT:Ethereum XRP:Ripple LTC:Litecoin BCH:Bitcoin Cash ADA:Cardano DOT:Polkadot XLM:Stellar Lumens | 1:1000 |

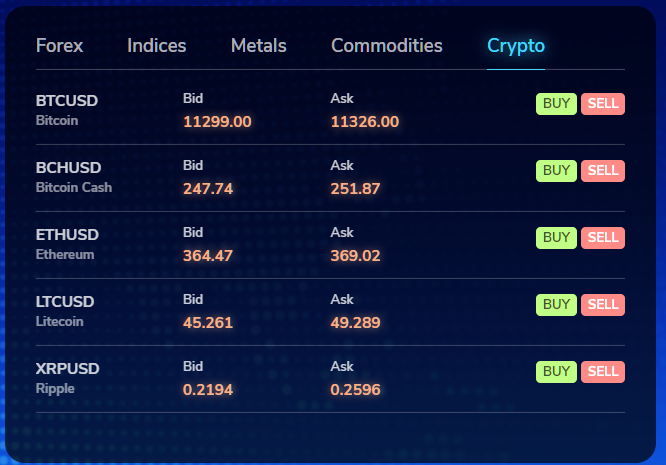

FBS | 5 Pairs (5 Cryptos) BTC:Bitcoin EHT:Ethereum XRP:Ripple LTC:Litecoin BCH:Bitcoin Cash | 1:3 |

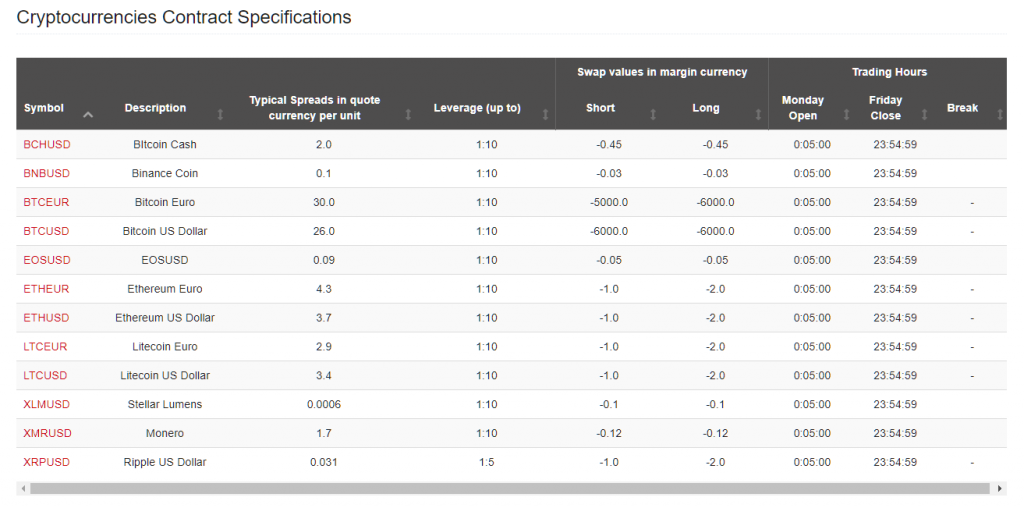

HotForex | 12 Pairs (9 Cryptos) BCH:Bitcoin Cash BNB:Binance BTC:Bitcoin EOS:EOS ETH:Ethereum LTC:Litecoin XLM:Stellar XMR:Monero XRP:Ripple | 1:10 (XRPUSD : 1:5) |

TitanFX | 18 Pairs (9 Cryptos) BCH: Bitcoin Cash BTC: Bitcoin ETH: Ethereum LTC: Litecoin LINK: Chainlink XLM:Stellar Lumens XRP: Ripple DOT: Polkadot EOS: Eos | 1:20 |

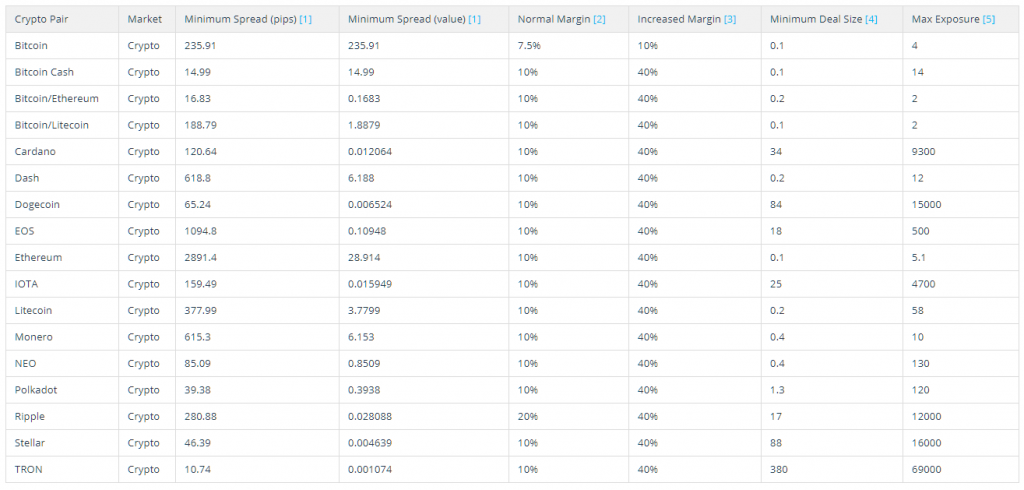

iFOREX | 17 Pairs (15 Cryptos) BTC:Bitcoin ETH:Ethereum XRP:Ripple BTC:Bitcoin Cash LTC:Litecoin DOGE:Dogecoin TRX:TRON ADA:Cardano XLM:Stellar IOTA:IOTA NEO:NEO DASH:Dash EOS:EOS XMR:Monero DOT:Polkadot | Bitcoin : 1:13.3 Ripple : 1:5 Others : 1:10 |

Tradeview | 5 Pairs (4 Cryptos) BTC:Bitcoin ETH:Ethereum LTC:Litecoin XBN:BItcoin Cash XRP:Ripple | Bitcoin : 1:10 Others : 1:5 |

TMGM | 5 Pairs (5 Cryptos) BCH:Bitcoin Cash BTC:Bitcoin ETH:Ethereum LTC:Litecoin XRP:Ripple | 1:5 |

Benefits of trading cryptocurrencies with Forex brokers

It is possible to trade with a small amount of money.

If you want to buy 1 BTC, you need $ 35,000 in cryptocurrency broker. (As of June 2021)

In forex broker, you can purchase 1BTC for only $ 140 with 1:1000 leverage.

If there is a sudden price drop, the amount of the fall will be a loss amount if you do spot trading in crypto broker.

But in the case of forex brokers, there is negative balance protection system, so you will not lose more than the deposited margin.

In other words, in the above example, the loss is only $ 140.

In other words, in this way, it can be said that it is suitable for short-term trading that uses the price volatility of cryptocurrencies and accumulates profits steadily with a small amount of funds.

- You can trade with less risk with small capital

- Take advantage of high leverage to aim for greater profits

- With a negative balance protection system, you won’t be in debt in any case

Introducing Forex Brokers that Can Trade Cryptocurrencies

I would like to introduce forex brokers that can trade cryptocurrencies, touching on their characteristics.

FXGT

FXGT allows you to trade 8 cryptocurrencies / 30 pairs.

The biggest feature is high leverage.

You can trade up to $ 3,000 with a leverage of 1000 times.

Leverage is limited as trading volume increases, but at least 20 times. However, it is 20 times more when trading over 200,000 USD.

If you are an ordinary trader, you can take advantage of high leverage, reduce risk as much as possible, and trade for large profits with a smaller amount of funds.

Leverage is not the only reason FXGT is the best broker for Bitcoin trading.

For details, please refer to the separate article “The Reason Why FXGT is the Best Broker for Bitcoin Trading“.

\Just 3 minutes!!/

Open an Account

FBS

FBS allows you to trade 5 cryptocurrencies / 5 pairs.

Actually there is no information about crypto trading on FBS official website, so there are some traders who don’t know about this.

Please be noted that you can trade cryptos only with MT5 and FBS Trader, an official trading app by FBS.

MT4 doesn’t allow to trade cryptos.

The maximum leverage is 3 times, not so high.

\Just 3 minutes!!/

HotForex

HotForex allows you to trade 9 cryptocurrencies / 12 pairs.

It is rare that not only Bitcoin and Ethereum but also Stellar and Monero are available.

The maximum leverage is 10 times, which is considerably modest compared to FXGT, but it is still higher than margin trading on crypto brokers.

\Just 3 minutes!!/

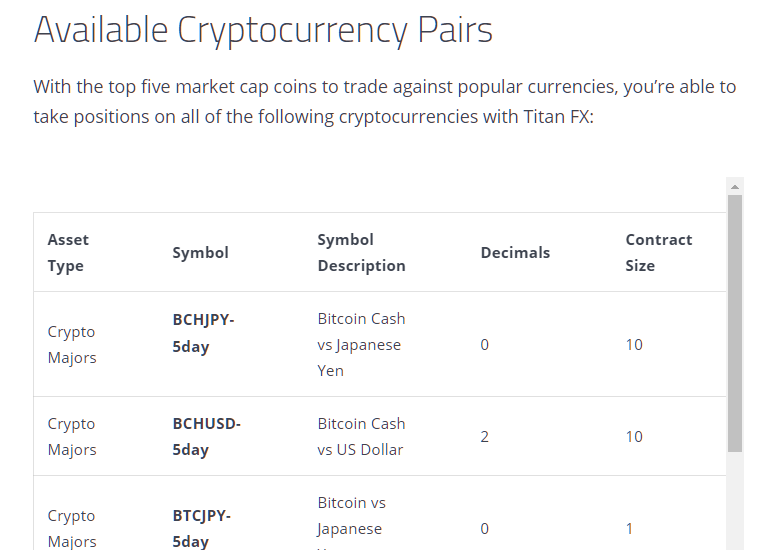

TitanFX

TitanFX allows you to trade 9 cryptocurrencies / 18 pairs.

It is rare that TitanFX offers Chainlink (LINK) trading. Among the brokers I have introduced, TitanFX is the only one.

The leverage is 20x, so you can make high-return trades using leverage.

\Just 3 minutes!!/

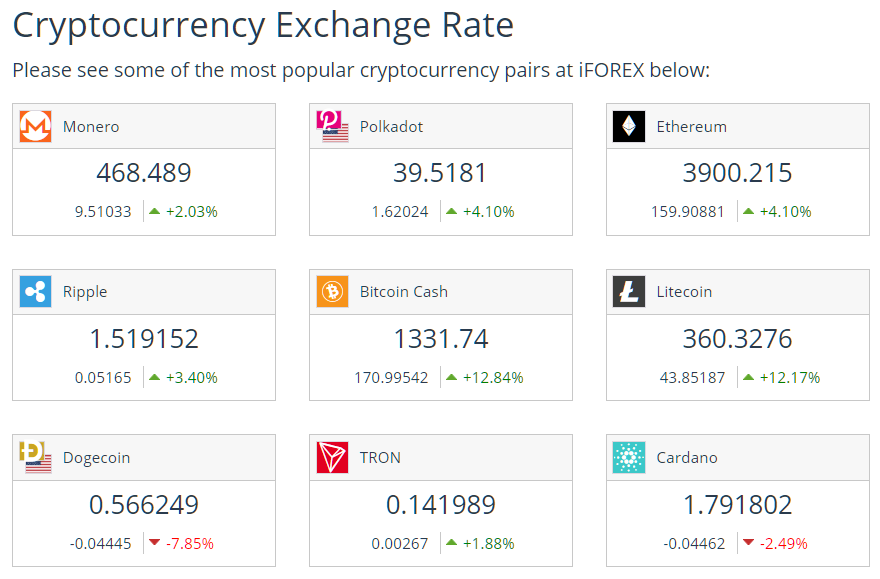

iFOREX

iFOREX allows you to trade 8 cryptocurrencies / 18 pairs.

There are more pairs than others.

The maximum leverage of iFOREX is 20 times for major Bitcoin currency pairs (BTCUSD, BTCEUR, BTCJPY) and 10 times for others.

However, when the market is quiet, such as on Saturdays and Sundays, the leverage limit will be applied and it may drop to 2.5 times.

iFOREX is also famous for its abundant handling of individual stocks, so if you have an account with iFOREX, you can trade various products only with Forex.

It can be used as a main account for one-stop various trades.

\Just 3 minutes!!/

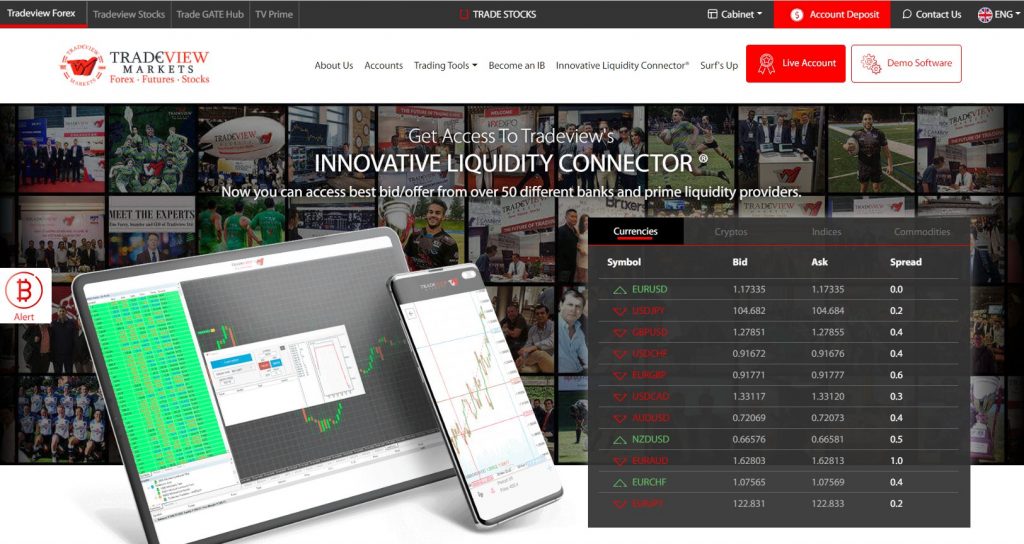

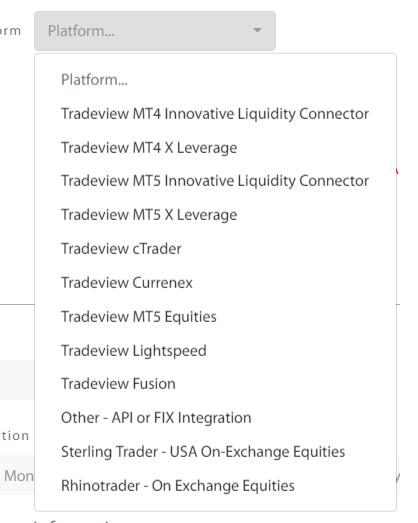

Tradeview

Tradeview allows you to trade 4 cryptocurrencies / 5 pairs.

Regard to maximum leverage, Bitcoin is 1:10 and others are 1:5.

Please note that only MT4 and MT5 account types can trade cryptocurrencies in Tradeview.

If you want to trade virtual currency, please select one of the following.

- Tradeview MT4 Innovative Liquidity Connector

- Tradeview MT4 X Leverage

- Tradeview MT5 Innovative Liquidity Connector

- Tradeview MT5 X Leverage

\Just 3 minutes!!/

TMGM (TradeMax)

TMGM allows you to trade 5 currencies / 5 pairs.

All pair currency is USD.

TMGM has a maximum leverage of 5 times, which is quite modest.

Even so, you can trade on the same platform as Forex, so there may be situations where you can take advantage of opportunities if you have an account in TMGM, such as trading cryptocurrencies only when opportunities come.

\Just 3 minutes!!/

>>TMGM(TradeMax) Official Website

Summary

How was it?

If you have been trading cryptocurrencies, want to trade with higher leverage, or want to start trading cryptocurrencies, I think this article was very helpful.

Lastly, once again, cryptocurrencies have large price fluctuations, so please do not suddenly trade in large lots.

While firmly recognizing the risks, I recommend that you make good use of the high leverage and negative balance protection system of forex brokers and trade as safely as possible.

コメント