AXIORY offers a convenient trading calculator.

Especially for beginners, it is very complicated to know how much money is per pips and to calculate the margin required for trading, and it varies depending on the currency pair or CFD.

AXIORY offers several calculation tools on its official website.

You can use them to do complicated calculations in one shot.

All of them are free of charge, even if you do not open an account with AXIORY. Try it out for yourself.

- About the AXIORY trading calculator

- What can be calculated with AXIORY’s trading calculator

- How to use the AXIORY trading calculator

What is AXIORY’s trading calculator?

These are the various calculation tools provided by AXIORY on its official website.

The following five calculation tools are available.

- Margin Calculator

- Currency Calculator

- Pip Calculator

- Swap Calculator

- Profit Calculator

How to access the AXIORY trading calculator

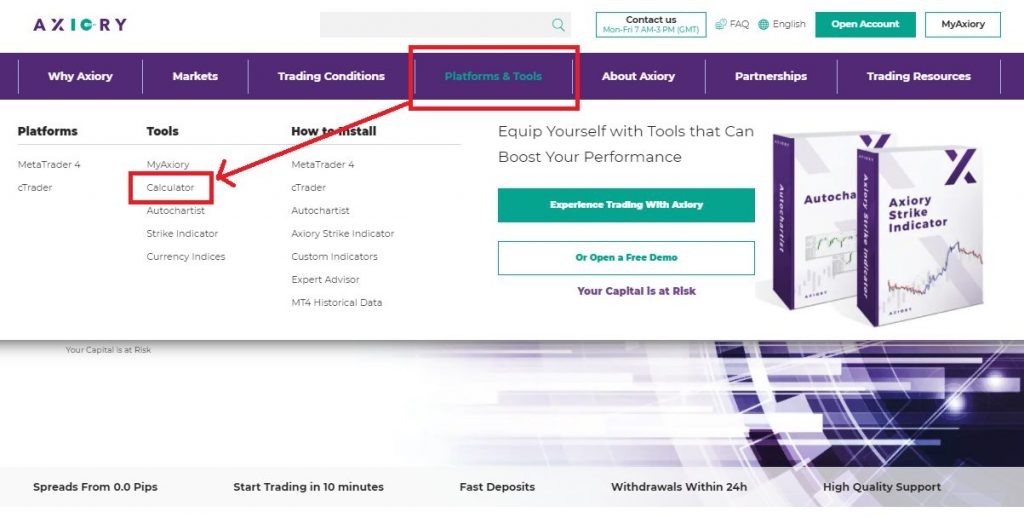

From AXIORY’s official website, follow Platforms & Tools -> Calculator.

How to use AXIORY’s trading calculator

From here, I will explain the specific usage of each calculation tool.

Common Descriptions

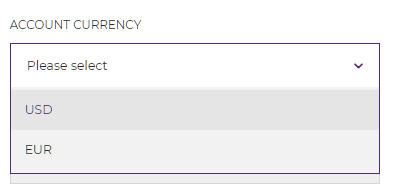

For each calculation tool, you need to specify the following

- Account Currency

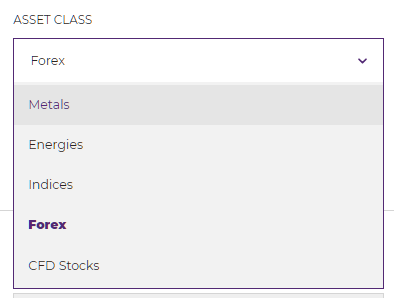

- Asset Class

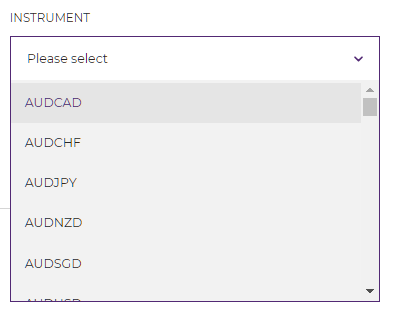

- Instrument

Margin requirements, pip values, etc. are calculated by converting them into amounts based on the account currency.

Eligible products can be selected from Forex (currency pairs), Metals, Energies, Indices and CFD stocks.

Once you select a currency pair and CFD product, you will be able to select the stocks included in it.

The following image shows an example of selecting Forex.

You can select the Currency Pair to calculate.

Margin Calculator

You can calculate how much margin you need to hold a position.

This is the tool I use the most.

You will use it not only as a beginner, but also when trading stocks that you do not usually trade.

Margin can be simulated by changing the leverage as well as the stocks.

- Want to know how much margin is required to place an order.

- Want to know how the margin requirement changes when the leverage is changed.

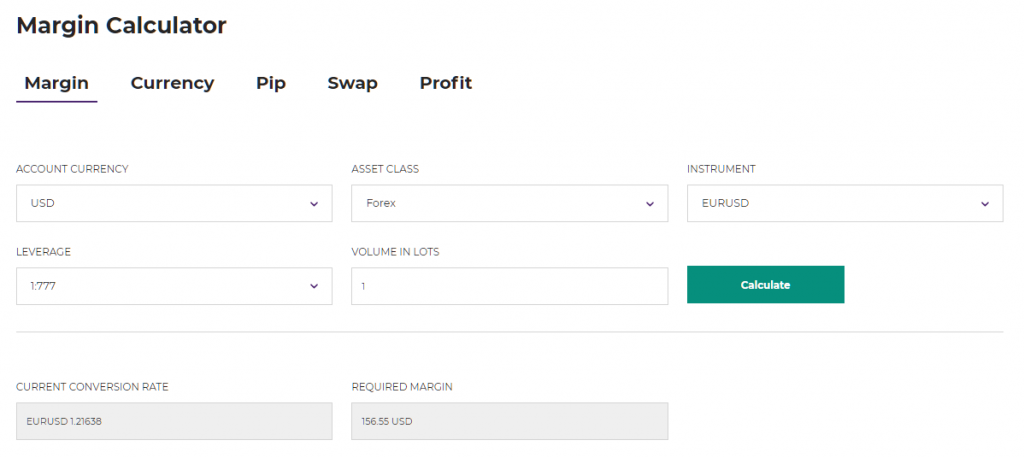

How to use Margin Calculator

Specify your Account currency, Asset class, Instrument, leverage, and lot size, then click Calculate.

The following example shows the margin requirement for trading 1 lot of EURUSD at 777x leverage.

If you use AXIORY’s maximum leverage of 777x, you can trade 1 lot of EURUSD for 156.55 USD.

Currency Calculator

This is a tool to check the current real-time rates of currency pairs.

This tool can only be used to check currency pairs.

Other CFD’s such as energy and precious metals cannot be checked.

- Want to know the current exchange rate.

- Want to know the amount of money converted into currency.

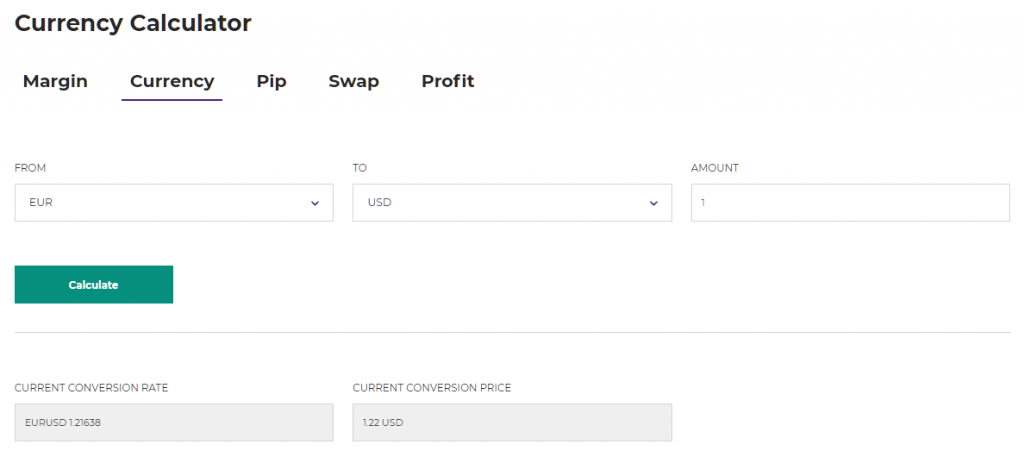

How to use Currency Calculator

Specify the source and destination currencies and amounts, then click Calculate.

Then, the amount converted at the current rate will be displayed.

The following image shows an example of converting one euro (EUR) into US dollars (USD).

You can see that at the current rate, 1 Euro is 1.22 USD.

Pip Calculator

You can find out the amount of money per pip (pips), which varies from currency pair to CFD.

One thing that is always confusing when you are just starting out in forex is the unit called pips.

Each currency pair or CFD product has a different amount in pips.

How much profit/loss will you make if the price goes up or down by 1 pip?

With this pip value calculator, you can easily find out.

- Want to know the amount of money per pips, which varies for each currency pair and CFD.

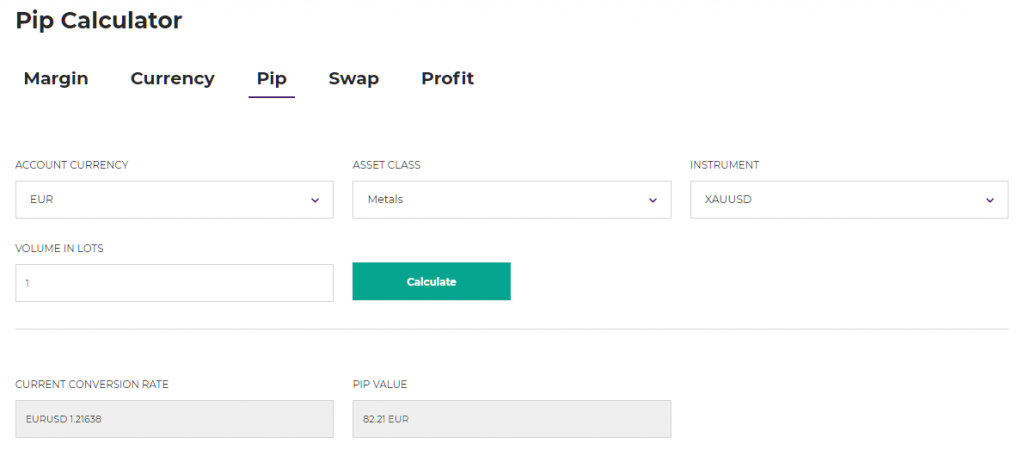

How to use Pip Calculator

Specify the account currency, asset class, instrument, and lot size for which you want to find the pip value, and click Calculate.

The image shows the calculation of the pip value for gold.

You can see that at the current rate, a 1 pip move in Gold will result in a 82.21 EURO move.

Since you have specified Euro as your account currency, the amount per 1 pip is shown in Euro.

Swap Calculator

Swap refers to the interest rate that is generated when a position is held across days (rollover).

Swap points are different for buy and sell positions.

AXIORY’s swap point calculator allows you to calculate different swap points for different currency pairs and CFD products.

- Want to know the swap points for holding positions across days.

- Want to know the swap points for both buy and sell positions.

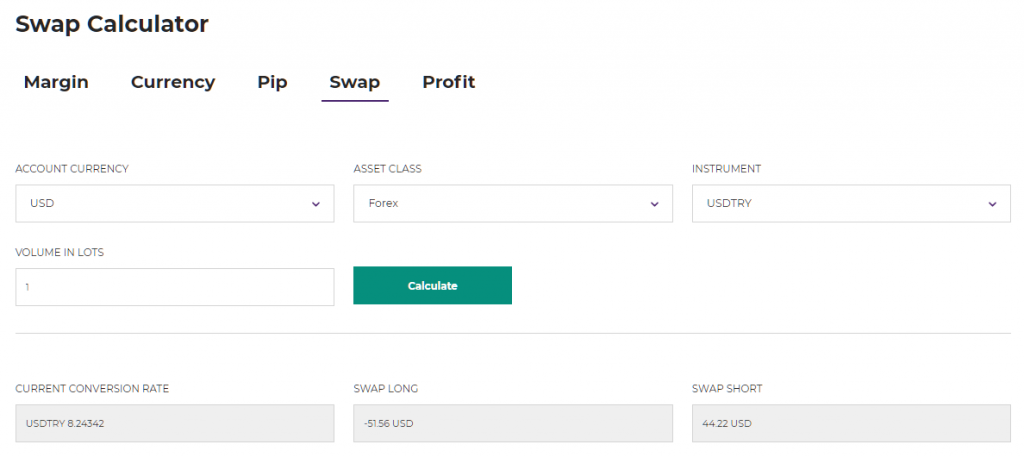

How to use Swap Calculator

Specify your account currency, asset class, instrument, and lot size, then click Calculate.

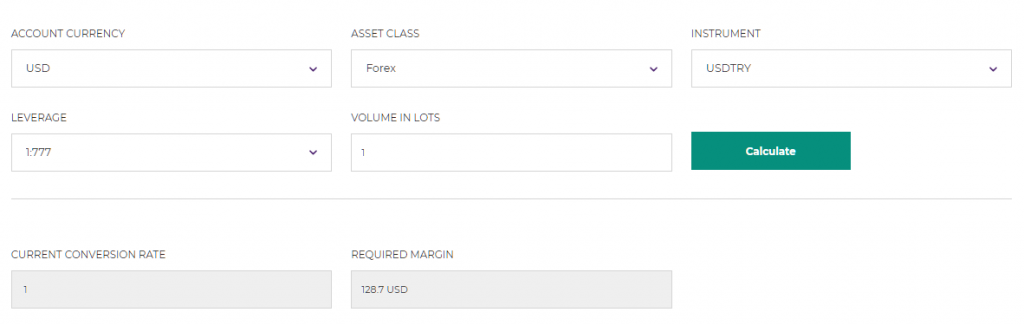

The following image shows the daily swap points for a 1 lot trade of USDTRY (USD Turkish Lira), which has large swap points.

Swap points are generated by the difference in policy interest rates between the issuing countries of the currencies you trade.

Some trading methods are aimed at earning these swap points.

The most famous currencies with large swap points are the Turkish lira, South African rand, and Mexican peso.

The Turkish lira, in particular, has a policy rate of 19.0% (as of May 2021), which means that its swap points are also very large.

At the current rate, if you hold a 1 lot USDTRY sell position, you can receive 44.22 USD in swap points per day.

FYI, the margin required to order 1 lot of USDTRY at the current rate is 128.7 USD when using 777x leverage.

As you can see, one trading strategy is to hold a position for medium to long term using high leverage and targeting swap points.

On the other hand, the volatility of these currencies is very high, so it is important to take proper risk management measures.

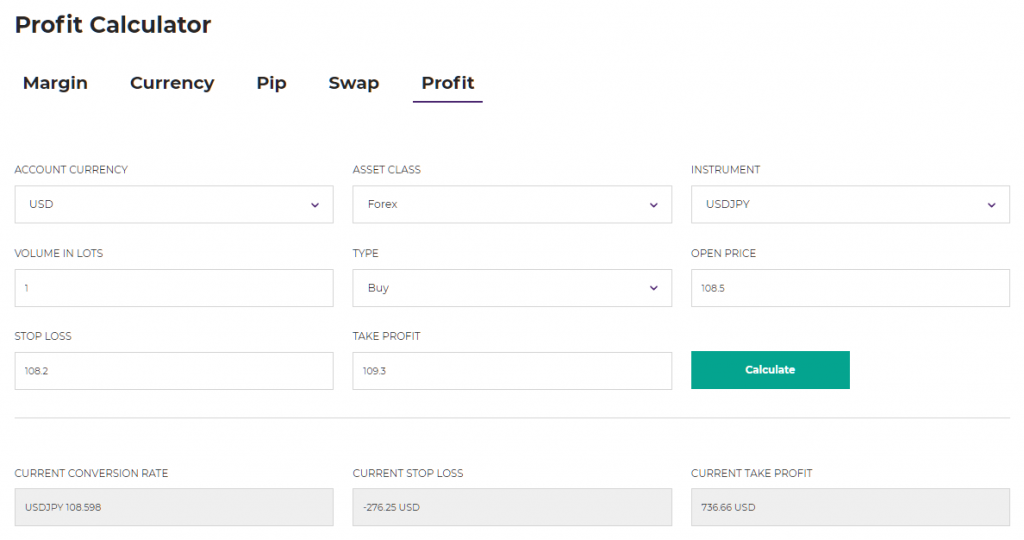

Profit Calculator

You can simulate how much loss or profit you will incur by specifying the stop loss and take profit when placing an order.

- Want to know how much I will lose/gain when I reach the stop loss/take profit I set.

How to use Profit Calculator

Specify the account currency, asset class, instrument, number of lots, and transaction type (buy or sell).

For Open Price, specify the assumed rate at the time of order, and for Stop Loss and Take Profit, specify the respective rates.

Click on “Calculate” to calculate the amount of loss or profit you will incur when the respective rates you specified are reached.

Summary

That’s all.

I still use the tool to calculate margin requirements and pip values when I trade unfamiliar currency pairs or CFD products.

I hope you will use it too.

\Just 3 minutes!!/

コメント